Looking for Additional Income, Government Pursues Taxes from Multinational Companies

With the implementation of the Global Minimum Tax, tax incentives as a "sweetener" for investment are no longer effective.

This article has been translated using AI. See Original .

About AI Translated Article

Please note that this article was automatically translated using Microsoft Azure AI, Open AI, and Google Translation AI. We cannot ensure that the entire content is translated accurately. If you spot any errors or inconsistencies, contact us at hotline@kompas.id, and we'll make every effort to address them. Thank you for your understanding.

/https%3A%2F%2Fasset.kgnewsroom.com%2Fphoto%2Fpre%2F2020%2F02%2F27%2F687bc8fc-64f1-45ed-bca1-0e74f1e50506_jpg.jpg)

Participants attending the Developer Economy Summit //DevCon/ in Jakarta, Thursday (27/2/2020).

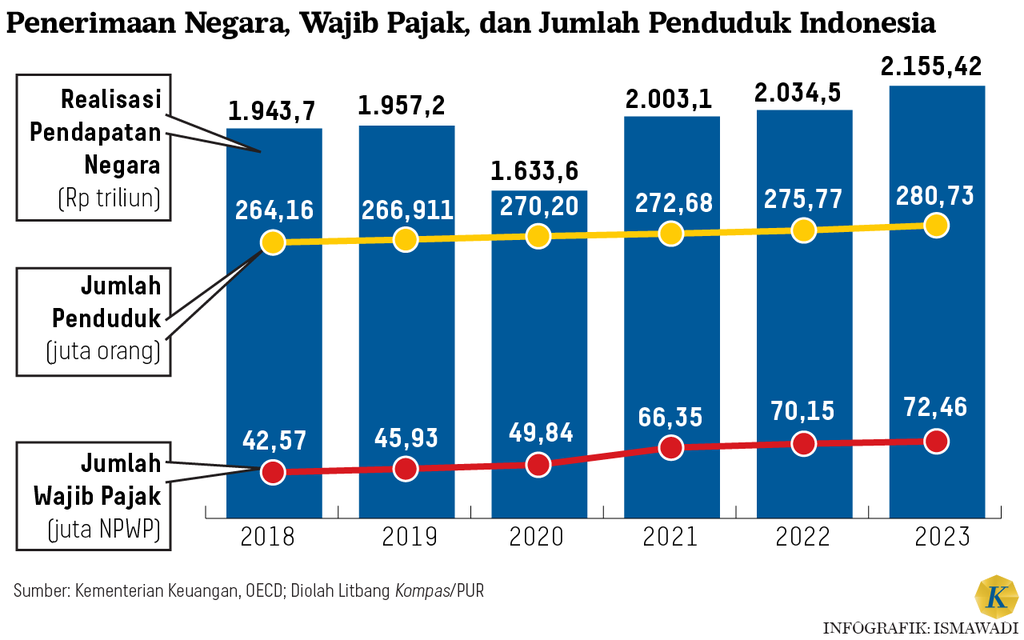

JAKARTA, KOMPAS – To increase revenue and finance growing spending needs, the government plans to be more aggressive in pursuing tax payments from multinational companies operating in Indonesia. This effort is made possible through the implementation of Global Minimum Tax. However, the implications for the investment climate need to be watched out for.

The plan to tax multinational companies was officially conveyed by Minister of Finance Sri Mulyani Indrawati at the Plenary Meeting of the House of Representatives (DPR) when conveying the government's views on the Macro Economic Framework and Fiscal Policy Principles (KEM -PPKF) Fiscal Year 2025, May 20 2024.

Sri Mulyani said that there are several ways that the government will take to encourage the optimization of state revenues in 2025. One of them is by expanding the tax base through the implementation of the Global Taxation Agreement or Taxation Agreement. Global.

Also read: Opportunities and Challenges for Implementing Global Minimum Tax

"Indonesia's commitment to implementing the Global Taxation Agreement is an opportunity to expand the tax base through taxation of multinational corporations that carry out cross-border transactions," he said.

With those various policies, it is estimated that the state's revenue in 2025 can reach around 12.14-12.36 percent of the gross domestic product (GDP). Meanwhile, the estimated state spending needs are expected to reach 14.59-15.18 percent of the GDP.

/https%3A%2F%2Fasset.kgnewsroom.com%2Fphoto%2Fpre%2F2024%2F05%2F20%2F23e15203-0175-495a-94b7-1f1bb2b6dc3c_jpg.jpg)

Finance Minister Sri Mulyani (left) presented the government's draft views and State Revenue and Expenditure Budget Plan (RAPBN) for the fiscal year 2025 to Deputy Chairman of the DPR Sufmi Dasco Ahmad during a plenary meeting at the Parliament Complex in Senayan, Jakarta on Monday (20/5/2024). The meeting agenda was to deliver the government's views on the macroeconomic framework and key fiscal policy points of the RAPBN for the fiscal year 2025.

Thus, the fiscal deficit in 2025 is estimated to be 2.45-2.82 percent of GDP. Although still below the safe limit of 3 percent, the deficit has significantly widened compared to the deficit in 2023 (1.65 percent of GDP) and the target deficit for this year (2.29 percent of GDP).

The umbrella policy for taxing multinational companies is included in Pillar Two Global Anti Base Erosion (GloBE) which regulates the implementation of the Global Minimum Tax (Global Minimum Tax). GloBE is a policy born from an agreement between countries to combat tax avoidance practices that have been carried out by many multinational companies, especially in the digital sector.

Digitalization allows multinational companies to operate across borders without the need to have a physical office in the target market country. Because they do not have a fixed place (fixed place) in the market country, the local tax authorities in that country have not been able to tax them.

Indonesia is currently a market country for several multinational companies. They reap great profits from the domestic market, but do not pay income tax because not all of them have offices in Indonesia. On the other hand, there are also Indonesian multinational companies operating in other countries that have lower tax rates, or intentionally evade their profits to tax haven countries.

Economist of Sustainable Development Indonesia (SDI) Dradjad Wibowo stated that Global Minimum Tax (GMT) is a proposal from OECD, supported by G20, and has now been agreed upon by more than 140 countries.

GMT is the minimum tax that must be paid by every multinational company that earns income from overseas. The minimum rate is agreed upon at 15 percent. The aim is to eliminate the benefits that multinational companies gain through placing profits in tax havens, allowing them to pay very little, or even no, corporate income tax. GMT also reduces the benefits gained by tax haven countries such as Barbados, Ireland, Luxembourg, and Switzerland.

"The question is, does Indonesia benefit from the implementation of GMT, and how much? Theoretically, it should. But in practice, I am not yet sure. The reason is that our taxation information technology (IT) system is still very weak, particularly in terms of integration and interoperability. As a result, the output data is also weak, making the enforcement of GMT difficult to maximize. The next reason is human factors and anti-corruption culture. This can also suppress the potential benefits of GMT. Finally, the factor of tax cooperation with other countries, especially Singapore and tax haven countries," said Dradjad, who is also Chairman of the PAN Expert Council.

According to Dradjad, his party supports Indonesia implementing GMT. But for the benefits to be realized, the three factors above need to be addressed as best as possible.

The potential is quite large

Tax Consultant and Co-Founder of Botax Consulting Indonesia, Raden Agus Suparman, stated on Sunday (May 26, 2024) that with the implementation of the Second Pillar and Global Minimum Tax agreements, the government will be able to impose income tax on multinational companies operating in Indonesia, as well as Indonesian multinational companies operating in other countries.

The agreed minimum effective tax rate in the Global Minimum Tax is 15% on income earned in the country where they operate. The tax rate applies to multinational corporations with consolidated revenues above 750 million Euros. The government targets the implementation of this policy to begin in 2025.

Also read: G-7 Minimum Tax Rate Agreement Has No Effect on National Taxation

Raden estimates that the potential revenue obtained from taxing income from digital product sales by multinational companies is quite large. "If in 2023 alone, we can gain VAT revenue from Electronic Trading Systems (PMSE) of Rp 16.9 trillion, the potential revenue from Income Tax on those companies could be even greater," he said.

Several preparations need to be made from now on, both in terms of legal framework and anticipation of the impacts of the implementation of the Global Minimum Tax. In essence, the regulatory framework has already been opened through Government Regulation (PP) Number 55 of 2023, which states that provisions regarding taxation due to economic digitalization based on agreements and agreements are regulated in Ministerial Regulations.

/https%3A%2F%2Fasset.kgnewsroom.com%2Fphoto%2Fpre%2F2019%2F10%2F07%2F4d0c2627-91be-4c21-9a19-d2085d4e3c89_jpg.jpg)

Illustration of the Google Indonesia office in Jakarta. Photo taken October 2019.

"Indeed, the hope is that the Ministry of Finance can promptly prepare the Minister of Finance Regulation (PMK) referred to as the basis for the implementation of Pillar Two in Indonesia," said Raden.

Impact on Investment

Another preparation is anticipating the side effects of implementing the Global Minimum Tax on the investment climate. As is known, so far Indonesia has implemented various tax incentives such as tax holidays and tax allowances to attract more foreign investors.

With the implementation of the Global Minimum Tax, tax incentives which have been a “sweetener” and investment lure are no longer effective. Because, globally, the multinational companies concerned are still required to pay a minimum of 15 percent tax. The tax can be paid to the source country or market (such as Indonesia) or to the country of residence (abroad).

Indonesia could “lose” if it refuses to implement the Global Minimum Tax. Because Indonesia will lose its taxation rights over related multinational companies. If the effective tax rate for multinational companies in Indonesia does not reach 15 percent, other countries where the company is headquartered have the right to impose tax on the difference in the rate (top-up tax).

The finance ministers of the G7 group countries and their partners are having a photo session at Lancaster House in London, Saturday (05/06/2021).

“This Global Minimum Tax is not in line with the incentives provided by Indonesia. "Companies that receive tax incentives in Indonesia may end up paying taxes in other countries, because Indonesia already has a tax holiday," said Raden.

Therefore, in the near future, there needs to be an evaluation of Indonesia's tax incentive policies that contradict the Second Pillar Agreement and the Global Minimum Tax. "We do not need to revoke all incentives, but adjust them in accordance with the Global Minimum Tax provisions, so that corporate taxes are still paid in Indonesia, not in other countries," he said.

According to researcher from the Center for Indonesia Taxation Analysis (CITA), Fajry Akbar, based on calculations from the Organization for Economic Cooperation and Development (OECD), both developed and developing countries can benefit from the implementation of a Global Minimum Tax. Developed countries benefit from the top-up tax mechanism as the home country of most multinational companies. Meanwhile, developing countries benefit from the reduction of profit-shifting practices by multinational companies.

"So, there is an additional increase in tax revenue resulting from the increase in tax bases due to the reduction of profit shifting. Lower-middle income and low-income countries will experience the biggest increase in tax bases due to the decrease in this profit shifting practice," said Fajry, without mentioning the forbidden words.

For Indonesia, the challenge ahead is to ensure the readiness of multinational companies operating in Indonesia to start paying corporate income tax (PPh).

"The good news is not all multinational companies fall under the scope of Pillar Two. Only large-scale companies with a turnover of more than 750 million euros need to prepare. Based on the calculation of the imposed tariff, the implementation of Pillar Two is indeed highly complex and can be quite burdensome for companies, so only large-scale ones are included," he said. Original Article: Rencana pembangunan gedung baru oleh PKS menuai pro dan kontra. Ada sejumlah orang yang menyambut antusias rencana ini, tetapi ada juga yang mengkritik keras. Seberapa tepat sebenarnya pembangunan gedung baru PKS di tengah keterbatasan anggaran? English Translation: The plan to build a new building by PKS stirs up pros and cons. Some people welcome this plan enthusiastically, but there are also those who criticize it harshly. How appropriate is building a new building for PKS in the midst of budget limitations?

Previously, Investment Minister Bahlil Lahadalia rejected the implementation of Global Minimum Tax in Indonesia. He argues that the policy is only a "trickery of developed countries". Developing countries like Indonesia still need tax incentives to attract more investment.

Bahlil said he had a different view from Finance Minister Sri Mulyani. "We at the Ministry of Investment have the key to attracting people to come. There must be sweetener. What is the most suitable sweetener for our country? "Yes, tax holiday,," he said.