The Collapse of SVB and Its Impact on Our Economy

The cascading impact of the collapse of SVB, Signature Bank, Credit Suisse on Indonesia seems to be limited. However, I would like to remind you that Indonesia has to be vigilant. The situation is still very vulnerable.

He looked so confused and also worried. There were crowds of people.

Some sat on the steps of the Federal Hall National Memorial. Others stood around the waist-high iron fence, which separated the worried crowds from the New York Stock Exchange building on Wall Street, New York City, the United States.

It was Sept. 29, 2008. I had just finished a meeting in Midtown, Manhattan, when the television announced that Congress rejected the US$700 billion bailout package proposed by the Bush administration to save the financial sector.

I decided to go to Wall Street. That day the stock market in New York crashed: the Dow Jones index fell more than 777 basis points, causing a loss of more than $1.2 trillion. The global financial crisis began. The financial sector has a lot of uncertainties. What is certain is a financial shock. And if it is not managed well, it can lead to a financial crisis.

The collapse of SVB

I was reminded of that situation when I read the news of the collapse of SiliconValley Bank (SVB), which is headquartered in Santa Clara, California. SVB is the 16th largest bank in the US. Its fall leaves a series of questions: What happened to SVB? Will the banking crisis occur in the US? Will the 2008 global financial crisis be repeated again? What is the impact on Indonesia?

To answer those questions, there are a few things we need to pay close attention to. First, SVB is a classic example of the danger of a high level of concentration, both in terms of assets and liabilities, in one bank. It is a classic example of bad diversification of risks.

It is an illustration of an ancient advice in financial science: Do not put all your eggs in one basket. Just look at this data: most of the sources of funds (liabilities) (67 percent) were concentrated on technology companies. On the asset side, around 58 percent were invested in US government bonds and mortgage-backed securities (MBS).

Also read:

> Silicon Valley and Our National Banking

Booming technology companies in 2019-2021, in the middle of the Fed's low interest rate, brought blessings for SVB. Third-party funds rose significantly, especially from technology companies. These funds were then invested in US government bonds, especially MBS. This choice was not wrong. MBS and US government bonds are safe asset classes. Most MBS, like bonds of course, are guaranteed by the US government.

Indeed, bonds, especially MBS, are very vulnerable to rising interest rates. SVB invested in the asset class. When interest rates are very low (value of bonds and MBS are relatively high). We know that since 2022 to control inflation the Fed has raised interest rates by 425 basis points. It is not impossible that an interest rate increase will continue to happen.

When the labor market in the US is tight, it is not impossible that the Fed’s funds rate will rise to 5.75-6 percent. Rising interest rates have caused the value of bonds and MBS to fall. As a result, the value of SVB's assets suffered a significant decline. Concerns about SVB's ability to return depositors' money (solvency) began to occur when on March 8, 2022 SVB sold its assets amounting to $21 billion, resulting in a loss of $1.8 billion. SVB incurred losses. Seeing this condition, the depositors were worried and started withdrawing their money from SVB. As a result, SVB was unable to pay back the money of its depositors.

So what is the cause of SVB's failure? Is it due to the Fed's interest rate hike? Not really. Fluctuations in financial markets are inevitable. The market moves due to price fluctuations. If the investments on MBS and bonds and the increase in interest rates were not the main cause of SVB's failure, then what was the cause? Poor risk management, because both assets and liabilities were highly concentrated. There was a mismatch in the duration of assets and liabilities; short-term funds were used for long-term asset investments, in addition to weak regulation and supervision.

What happened to SVB is a classic example of a bank run where depositors took their savings out of fear that the bank would collapse. Nobel laureate in economics, George Akerlof, in his seminal work, The Market for Lemons, explained the concept of asymmetric information.

People do not have perfect information. Imagine if we have savings in a bank and the amount of savings is greater than what is guaranteed by the deposit insurance agency, then we hear that the bank is starting to experience difficulties. What should the people do? Rationally, people will withdraw their money even if we do not know exactly the real condition of the bank.

Also read:

> The Rescue of Troubled Banks in America, Prevent Global Crisis

> Bank Failure in a Time of Tight Money

People tend to avoid risk. As a result, people start withdrawing their money from the bank. A self-fulfilling prophecy occurs. The more people withdraw their money from the bank, the greater the probability of bankruptcy. Uncertainty in the financial sector will encourage animal spirits and herd behavior.

In an uncertain situation, individuals in a group will try to reduce risk by moving according to the group's pattern. It does not stop there; a chain effect occurs. After SVB collapsed, Signature Bank followed. Then Credit Suisse, which had been in trouble for some time, was taken over by UBS.

Will a banking crisis occur and trigger a global financial crisis? It is too early to be sure. Uncertainty is so high in the financial market and there is so much information that we do not know. However, the steps taken by regulators in the US to guarantee depositors' money and the acquisition of Credit Suisse by UBS are at least able to calm the market. The guarantee that depositors' savings will be paid lessens herd behavior.

Will a banking crisis occur and trigger a global financial crisis?

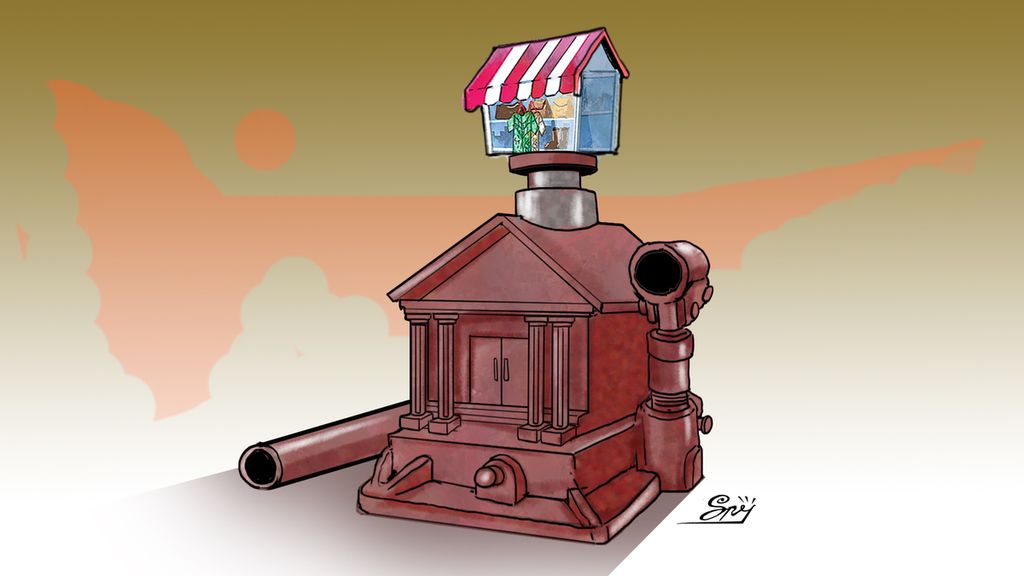

The world's central banks, especially The Fed, are currently in a dilemma. On one hand, they should do monetary tightening by raising interest rates. On the other hand, there is concern that interest rate increases will cause a stability problem in the financial sector. It is true that inflation and the stability of the financial sector are two different things and can be overcome by using different instruments.

The European Central Bank, for example, last week kept raising interest rates and gave forward guidance to guide the market rather than maintaining the stability of the financial sector. However, the problem is, there is a risk of asymmetric information that may be sensitive to monetary policy. Therefore, the best step is to closely monitor market developments and banking conditions to decide what monetary policy will be taken.

Impact on Indonesia

What is the impact on Indonesia? There are two lanes: the financial channel and the trade channel. From a financial perspective, the direct relationship from banking in Indonesia to SVB and Signature Bank is very small. However, there is something that needs to be observed and kept under close observation: common creditors. I remember a discussion I had with economist Carmen Reinhart from Harvard University a few years ago. According to Reinhart, the risk of capital outflow as a result of a shock in the country of origin will be exacerbated if there are common creditors.

It is as simple as this: If investors in SVB have investments in the Indonesian financial market, they will study their portfolio. If they suffer losses, it is not impossible for them to reduce their portfolio in Indonesia, even though Indonesia has nothing to do with the origin of the shock. In addition, as can be imagined, fund managers are people who have to closely monitor dozens of countries where they invest.

Not all of them have complete information. They tend to be top down by using quantitative data as a reference, such as for example the current account deficit (current transaction balance/NTB). If the indicators they use show worrisome signs, they will pull the portfolio. In this context, Indonesia's risk is relatively small because the portion of foreign ownership in government obligations is relatively small (less than 15 percent). NTB is also relatively well managed, as is inflation.

Also read:

> Closure of Silicon Valley Bank Will Not Directly Impact Indonesia

> Global Recession and Policy Choices

That is why, I suspect, the impact of the financial channel will be relatively limited. What is the impact of the trade channel? It depends on whether the central bank of the world will raise interest rates. If interest rate hikes continue, the economic impact will appear through economic contraction in developed countries, which in turn will lower our exports. However, as I have written in this daily, our export portion of the gross domestic product (GDP) is relatively small, so the probability of a recession is relatively small. What will happen is an economic slowdown.

The cascading impact of the collapse of SVB, Signature Bank and Credit Suisse on Indonesia seems to be limited. However, I would like to remind you that Indonesia has to be vigilant. The situation is still very vulnerable. A shock can happen at any time. Bank health monitoring and stress tests should be done in detail for various scenarios. Concentration on the side of assets and liabilities should be monitored, as well as concentration on loans and the duration of assets and liabilities.

What we know about the global financial crisis is that we don't know very much.

Regulators should also pay attention to liquidity indicators in all banks in detail. A banking crisis can be triggered by a black swan. Although the situation is generally good, a surprise in a small bank can trigger animal spirits. That is why we should be vigilant. It is better to make a mistake because you are too conservative (type 1 error or false positive) than to make a mistake because you take too many risks (type 2 error or false negative).

It is good for us to remember what the Nobel laureate in economics, Paul Samuelson, said: "What we know about the global financial crisis is that we don't know very much." Samuleson is right; there are many things we do not know. That is why caution is necessary.

/https%3A%2F%2Fasset.kgnewsroom.com%2Fphoto%2Fpre%2F2018%2F02%2F23%2F7dd5ca98-8284-4fa2-bd98-c12f2d195a5d_jpg.jpg)

Muhamad Chatib Basri

Muhamad Chatib Basri, Lecturer at the School of Economics and Business, University of Indonesia

This article was translated by Hendarsyah Tarmizi