Nobel Prize in Economics and Recession

It is no coincidence that the 2022 Economic Awards were given to thinkers of crisis and recession.

Ben S. Bernanke (Brookings Institution), Douglas W Diamond (University of Chicago) and Philip H Dybvig (Yale University), together or individually, are able to explain the role of banking in the modern financial crisis. In the closing remarks of the academic paper, the Nobel Committee underlined the warning of Nobel Prize laureates in preparing for the next financial crisis.

And, the warning is especially relevant because we are standing before a dark corridor of a recession that may be deep and long.

Through empirical research, Bernanke, who was the chairman of the Federal Reserves (2006-2014) showed how banking and the financial sector played a key role in accelerating the crisis, especially during the Great Depression of 1929. The theory about financial accelerators is relevant to this day. Meanwhile, Diamond and Dybvig provide a theoretical basis for panic in the banking sector (bank run) that can lead to systemic risk and emphasize the importance of institutional aspects such as guarantee institutions as well as strong regulation and supervision.

Their thoughts have relevance and urgency, both during the 2008 global financial crisis, the crisis due to the pandemic and the post-pandemic phase marked by the crypto-asset revolution.

These three economists have a similar premise, namely, the financial sector tends to exacerbate the economic cycle.

The recipients of the Nobel Prize in Economics have laid the groundwork on how financial-sector regulation should be established so that their views are also relevant to the discussion regarding the bill on financial sector development and strengthening (RUU PPSK).

Regulatory pendulum

These three economists have a similar premise, namely, the financial sector does not work in a neutral manner, but tends to exacerbate the economic cycle. This thinking is the antithesis of the Modigliani-Miller theory regarding the irrelevant capital structure in economic dynamics (irrelevance finance). These two financial experts also won the Nobel Prize in economics: Franco Modigliani in 1985, and Merton Miller in 1990, along with Harry Markowitz and William F Sharpe.

Miller received the Nobel Prize in Economics while affiliated with the University of Chicago. Besides him, there are many Nobel Prize winners in Economics hailing from this university, such as Milton Friedman (1976) and Eugene F Fama (2013). Friedman and Fama are hardline advocates of the market mechanism. They both have the hypothesis that the market mechanism is the most efficient so that intervention (regulation) should be minimal.

When Diamond was asked to give a speech at the University of Chicago, he acknowledged that he was surprised that his pro-intervention and regulatory thinking was recognized even though he did not agree with the "Chicago school". In the academic world, thesis and antithesis are normal dialectics that are eternal. It is precisely the dialectic that keeps the intellectuals motivated. It is undeniable that the pro-market view is being challenged since the 2008 global financial crisis and during the Covid-19 pandemic. And now, the view of pro-regulation and intervention is more relevant.

Since the era of the liberalization of the financial sector, crises have also emerged more frequently.

The series of financial crises in the modern era show how the financial sector plays a role in propagation or accelerating the economic cycle so that the dynamics of the economy are marked by various shocks. Since the 1980s, crises have continued to occur more rapidly (citius), higher (altius) and stronger (fortius) -- like the Olympic motto.

Since the era of the liberalization of the financial sector, crises have also emerged more frequently, including the banking crisis in the United States (1981), Black Monday (1987) in the US financial market, the banking crisis in Scandinavia (1990) and Black Wednesday (1992) in Europe. After that, the crisis spread to developing countries, starting with the Tequila crisis in Mexico (1995), the Asian crisis (1997), the Russian crisis (1998) and Argentina (2002). The peak of this crisis series was the 2001-2009 global financial crisis with the US financial market as the epicenter.

The global financial crisis was triggered by low-quality housing loans (sub-prime mortgages), which spread rapidly to almost all banking financial sectors. Many well-known companies such as Lehman Brothers, which had been around since 1850, went bankrupt. Many other large companies had to be rescued with very large capital injections.

One of the most important stories of the crisis series is the large number of unhealthy assets created during the liberalization phase of the financial sector and innovation of investment instruments. This asset bubble was created due to a maturity mismatch; short-term loans were used to finance long-term investments. Therefore, banking as an intermediary institution naturally has vulnerabilities.

Banks, no matter how strong they are in facing the panic of depositors during a crisis, will surely run out of liquidity. That is what Diamond and Dyvig theoretically have proved.

The crisis has forced the government to intervene and be directly involved in the dynamics of the economy.

And because it naturally has a fragile nature, in addition to strong supervision and regulation, a deposit insurance institution is also needed so that it is not vulnerable to panic behavior. The paper, which was published in the Journal of Political Economy (1983), is considered an important foundation in managing the 2008 global financial crisis. The global financial crisis is considered to be the end of the liberalization phase of the financial sector with the hypothesis that the market will work efficiently. This principle is often known in public discussion as neoliberalism.

The crisis has forced the government to intervene and be directly involved in the dynamics of the economy, through various stimuli and interventions. The era of stimulus continues due to pressure from the pandemic. Even at the extreme, the government has become the epicenter of economic dynamics because the pulse of the economy has stopped due to the pandemic. The need for such a large stimulus was covered by the massive issuance of debt securities so that the financial market also oversupplied.

The October 2022 edition of the World Economic Outlook quarterly report published by the International Monetary Fund (IMF) estimates that global growth in 2023 will shrink from the original estimate of 2.9 percent to 2.7 percent, while developed countries will experience a drastic slowdown. The global recession haunts the economy in 2023 due to high inflation and the high interest rate policy amid high government debt.

Referring to the thoughts of the recipients of the 2022 Nobel Prize in Economics, it seems that government policies have also created the vulnerability of the financial sector. The policy of low interest rates that has lasted for a long time is considered to have contributed to creating a financial asset bubble. The insistence that the central bank should immediately raise interest rates is noteworthy, even though raising interest rates too quickly may also cause a slowdown in the economic recovery.

Of course there are various unexpected factors that have created uncertainties in the economic policy.

Even so, it seems that a lesson can be drawn that the government or the monetary authority must be able to move quickly and act ahead of the curve.

Digital revolution

The 2008 global financial crisis had several implications. First, the level of public trust in intermediary institutions (banks) and other financial institutions dropped drastically. The people tend not to put their funds into formal financial institutions.

Second, the regulation and supervision of the banking sector is more stringent. The crisis has prompted the Bank of International Settlement (BIS), the coordinator of central banks around the world, to implement Basel III or a set of regulations for banking and the financial sector that is much stricter than before.

In 2008, a short treatise was published titled “Bitcoin: A Peer-to-Peer Cash System” written by a person claiming to be Satoshi Nakamoto. This paper is the beginning of the emergence of cryptocurrencies whose circulation has soared after the pandemic. Cryptocurrencies/assets continue to develop along with the adoption of technology in the financial sector as well as the development of a decentralized finance (De-Fi) system.

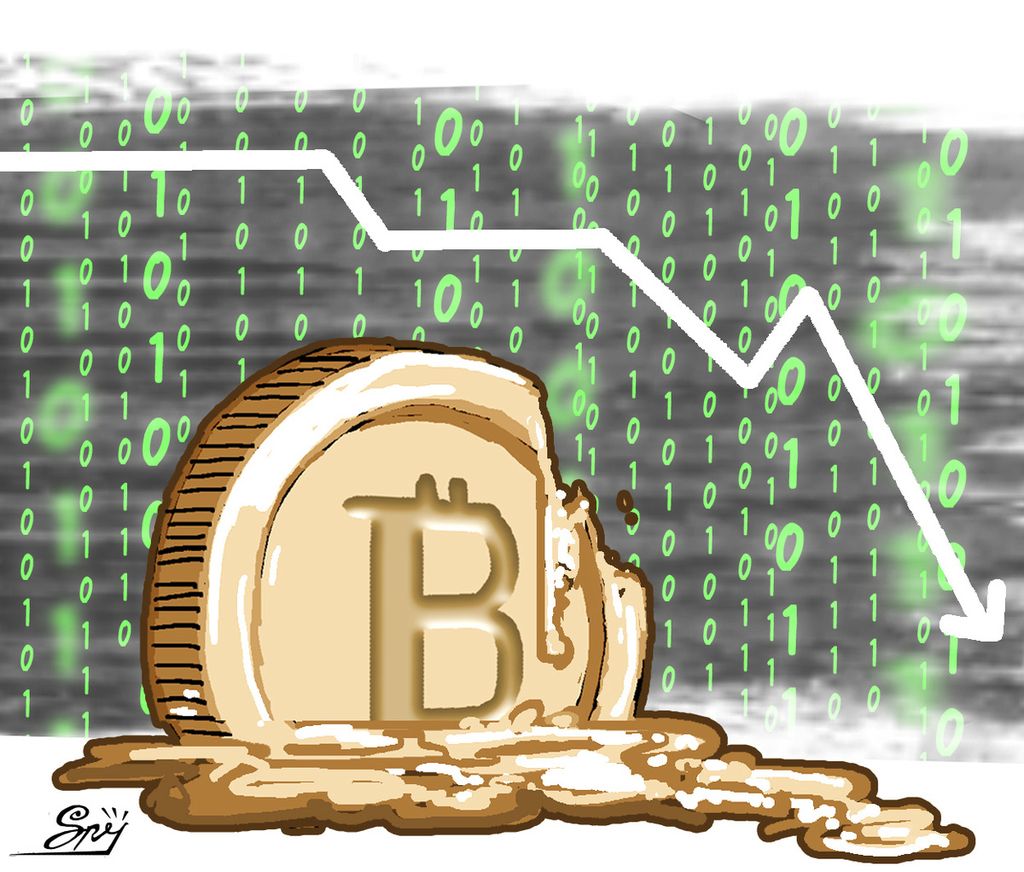

The capitalization value of the 100 largest cryptocurrencies has shrunk by around 62 percent.

In recent times, with the potential for a recession marked by a progressive increase in interest rates across the world, the prestige of crypto-assets is waning. Winter is hitting the crypto-world, known as the "Crypto Winter". The capitalization value of the 100 largest cryptocurrencies has shrunk by around 62 percent from late 2021 to the middle of this year. A similar fate is experienced by voters of other digital assets, such as non-fungible tokens (NFTs). Even so, many people believe that cryptocurrencies and assets will continue to grow, especially if the Metaverse-era has begun to be realized. Metaverse will drive cryptoization in the De-Fi era.

In Indonesia, crypto investors amount to 16 million, larger than 9 million capital market investors and around 8 million mutual fund investors. The figure is even much larger than the number of owners of Government Securities (SBN), which is only around 700,000.

The rise of investment in crypto-assets has given rise to various illegal practices, such as the Binomo case with a turnover of around Rp 44 billion, the Robo trading Fahrenheit case with total managed funds reaching hundreds of billions of rupiah.

Learning from the experience of financial-sector innovation that led to crises and recessions, policymakers need to be assertive by including the crypto sector in the radar of financial-sector stability. The PPSK bill needs to explicitly regulate crypto and De-Fi assets as part of the financial technology sector. Its movement must also be monitored in the Financial System Stability Committee (KSSK).

The recipients of the 2022 Nobel Prize in Economics have laid a solid foundation for the idea that the banking and financial sector can accelerate the occurrence of crises and recessions, so that regulation and strengthening of institutional aspects are unavoidable. The adoption of the central bank technology through the issuance of a digital-based official currency (central bank digital currency) is needed as part of a proactive measure to respond to the development of the situation.

The warning of the 2022 Nobel Economics recipients underlines the theory that the financial sector (especially banking) has a major role in creating a strong economic system in the long-term. However, without strong management, the banking and financial sector may, instead, cause crisis shocks that can hurt long-term goals. Therefore, there is a need for regulation, supervision and a strong institutional system in the financial sector, both conventional and digital, which is currently growing rapidly. Policymakers need to be ahead of the curve.

/https%3A%2F%2Fasset.kgnewsroom.com%2Fphoto%2Fpre%2F2019%2F02%2F13%2F9edb6176-ae2b-4785-8fbe-0eba1106b7ca_jpg.jpg)

A. Prasetyantoko

A Prasetyantoko

Rector of Atma Jaya Catholic University.

The article was translated by Hendarsyah Tarmizi.