Indonesia Moves Away from Recession

The government needs to continue to monitor the global condition and anticipate the worst that could happen at any time. It is necessary to simulate a variety of possible scenarios, from the best to the worst.

Indonesia's economic growth continued to show improved performance in the past year.

Gross domestic product (GDP) growth in the second quarter of 2021 was 3.51 percent year-on-year (yoy), and then increased to 5.02 percent in the fourth quarter of 2021. Then, it reached 5.01 percent in the first quarter of 2022 and then 5.44 percent in the second quarter of 2022.

The national economy’s performance showed consistent growth in the past year, so it can be said that Indonesia has passed a variety of tough tests since the Covid-19 pandemic emerged in 2020. The world economy had many ups and downs and showed uncertainty due to various factors. But as a matter fact, it did not pose a barrier to Indonesia's growth rate.

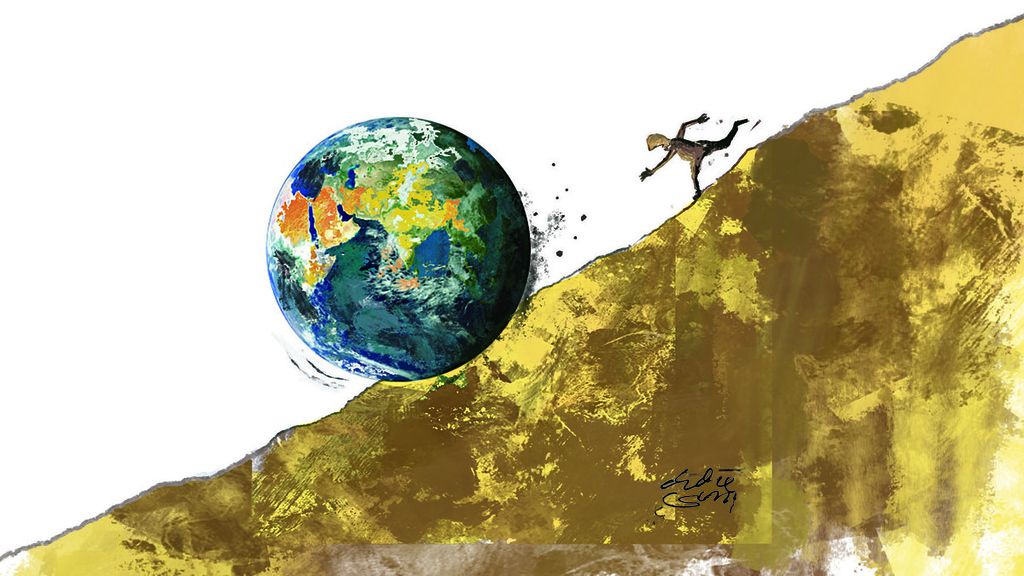

The Indonesian economy continues to grow expansively and increasingly away from a recession, which is now threatening other countries. This was possible because of its success in formulating a macroeconomic and monetary policy mix that met the 3T of on time, the right policy and on target.

It has been on time because the government was very quick to issue various policies at the beginning of the pandemic, so the negative impacts in the economic sector could be suppressed and mitigated as well as possible. It has been the right policy because the government has made various policies to overcome slowdowns in various sectors, so the downturn in certain economic sectors has been successfully minimized.

Also read:

> Notes for Recovering the Economy

It has been right on target, considering that the policy is very clearly aimed at industry and business actors as well as people in need, so those affected by the pandemic receive concessions and subsidies.

Expansive growth in the second quarter of 2022 was also experienced by Singapore (4.8 percent), the Philippines (7.4 percent), Vietnam (7.7 percent), and Malaysia (8.9 percent), while Thailand reached only 2.5 percent growth. Some countries in the European Union also experienced an increase, such as the United Kingdom (3.2 percent), Italy (1.0 percent), and Spain (1.1 percent). However, others have stagnated, such as Germany, which grew zero percent in the second quarter of 2022.

In other parts of the world, the risk of recession is starting to reemerge. The United States, as the world’s largest economy, contracted minus 1.6 percent and minus 0.9 percent respectively in the first and second quarters of 2022.

Indonesia's key to success

Indonesia's stable and expansive economic growth in the first six months of 2022 is due to several factors. First, the expansionary monetary policy that has maintained low interest rates has had a very positive impact on the economy.

Amid the threat of an increase in the benchmark interest rates of several central banks in the world, Bank Indonesia (BI) benchmark has maintained its interest rate at 3.50 percent since February 2021. This condition has been very helpful and has allowed banks to extend credit at low rates. Bank credit continues to show growth from Rp 5.756 quadrillion as of December 2020 to Rp 6.156 quadrillion as of June 2022.

The increased credit growth has had a tremendous impact on economic activity, both consumption and investment, the main contributor to economic growth.

Second, the low rate policy was able to maintain loose liquidity in the market. This can be seen in the narrow sense from the growth in the money supply (M1) that reached 16.60 percent yoy as of June 2022, while in the broad sense, the growth in the money supply (M2) reached 10.64 percent in the same month.

M1 is money that is circulating in the public and can be used directly for payments and transactions, while M2 is M1 plus money stored in savings and time deposits. The ratio of liquid assets to third-party funds in the banking sector reached 29.99 percent as of June 2022, so banks still have enough ammunition to support intermediation.

Meanwhile, the growth of public deposits in the national banking system continued to grow, reaching 9.13 percent in the same period.

Third, the accommodative fiscal policy has greatly helped the pace of economic growth. One of the policies that has had a positive impact is the provision of subsidies to various sectors.

The government has distributed various subsidies, such as a fuel subsidy, electricity subsidy, wage subsidy for workers, direct cash assistance (BLT) for MSMEs, the village fund BLT, the cooking oil BLT, the Family Hope Program, and many more. The subsidy budget for 2022 is around Rp 578.1 trillion. All this has been done to maintain people's buying power to curb inflation.

Without the fuel subsidy, the prices of fuel will be increased in line the currently high prices of the market mechanism. As a result, the prices of goods and services could soar out of control, considering that fuel is one part of the production cost that producers and service providers must take into account.

Also read:

> Impact of the Global Economic Recession

Fourth, the rising prices of several commodities in the last two years have provided a windfall income to the government. The price of crude oil, which reached US$40 per barrel at the peak of the 2020 pandemic, jumped to $68 in 2021 and $102 in 2020. For every $1 increase in the per barrel price of crude oil, the government earned a windfall of Rp 400 billion. The government took advantage of this to strengthen various types of subsidies.

For coal, the reference coal price was still in the range of $50 per tonne in 2020, which then increased to $160 per tonne in 2021 and $319 per tonne by July 2022. The surge in coal prices is a response to the energy crisis in many countries. Developed countries that stopped importing natural gas from Russia have reactivated their fossil energy sources.

Fifth, the manufacturing sector continues to show an increasing trend in performance, as reflected in the Manufacturing Purchasing Managers’ Index (PMI) data of BI, which rose from 51.77 percent in the first quarter of 2022 to 53.61 percent in the second quarter. The manufacturing industry has been the main contributor to Indonesia's GDP. The increase in PMI was triggered by increases in the number of orders for goods, the production volume of goods, and the finished goods inventory.

Meanwhile, the PMI for June 2022 is 50.2. Although still expanding, the achievement is slightly below 51.3 in March 2022. An increase in the price of imported raw materials caused a slight decline in the production volume of some manufacturing sectors.

In general, the two indices describe industrial performance, which continues to move expansively.

Future uncertainty

We can currently boast to the international community that the Indonesian economy is still immune from the threat of recession, and even the threat of stagflation that many countries fear.

However, the high level of future uncertainty carries the risk of new problems for all countries, including Indonesia. The World Bank and the International Monetary Fund (IMF) have forecast a growth slowdown this year. Global growth, which reached 5.7 percent in 2021, is expected to slow to 2.9 percent in 2022. In fact, some economists have predicted the global economy would become increasingly bleak and dark in the future, at a growth range of only 1.8-2 percent.

There are several contributing factors. First, the world is currently at risk of stagflation due to a very high inflation rate accompanied by a downward growth trend.

For Indonesia, this could weaken exports and hinder investments. The rapidly accelerating inflation needs to be continuously monitored and cannot be taken lightly, because it can have a very dire impact on businesses and the public. The rising prices of goods not only reduce buying power, but also have the potential to increase unemployment and poverty.

Also read:

Second, the world is currently experiencing three serious threats that can have a very wide domino effect: rising energy prices, rising food prices and geopolitical risk. Rising energy and food prices have claimed many victims, including Sri Lanka, Pakistan, Panama, Ecuador and South Africa.

Rising energy and food prices pose a risk of more people falling below the poverty line. Meanwhile, the geopolitical risk resulting from the Russia-Ukraine war has affected the supply chain of raw materials for production activities. Geopolitical risks are increasing at this time with the rising political tension between China and Taiwan.

As a result of global economic uncertainty, central banks in various countries have tightened their monetary policies by increasing their benchmark interest rates. BI is no exception, as it recently raised its benchmark interest rate from 3.50 percent to 3.75 percent in response to current economic conditions.

The government needs to continue to monitor the global condition and anticipate the worst that could happen at any time. It is necessary to simulate a variety of possible scenarios, from the best to the worst. To respond to the condition, the government can prepare various policy mixes from now on that meet the 3Ts of the right policy, on time and on target. This way, the policies can be executed immediately if the anticipated scenario actually occurs.

Agus Sugiarto

Agus Sugiarto, Head of the Financial Services Authority (OJK) Institute

This article was translated by Kurniawan Siswo.