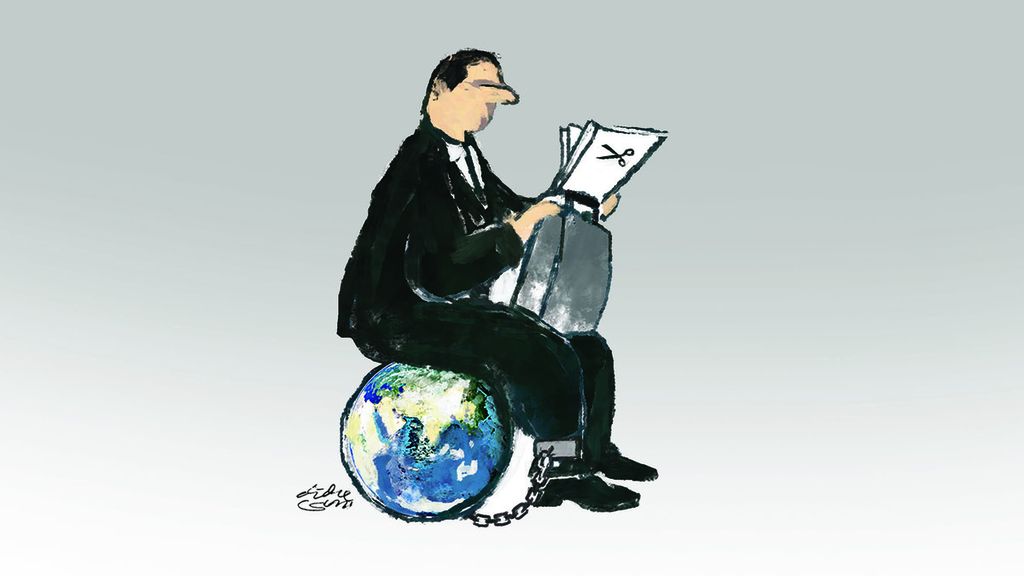

Maintaining Fiscal Sustainability Amid Global Uncertainty

There is no other choice but to continue to reform the main sources of state revenue. This is the only certainty in maintaining fiscal sustainability.

There is always a silver lining to global uncertainty.

Until the first semester of 2022, the State Budget (APBN) has had a bright face. This is indicated in the realization of state revenue, which remains in a surplus.

In a statement dated 27 July 2022 from the Minister Finance regarding developments in the State Budget, the surplus reached Rp 73.6 trillion, equivalent to 0.39 percent of gross domestic product (GDP). In aggregate, the budget surplus comes from the higher realization of state revenue at Rp 1.32 quadrillion compared to the realization of state expenditure, which amounted to Rp 1.24 quadrillion.

The silver lining was the APBN surplus, which was supported by two main factors, namely the surge in commodity prices (commodity boom) and higher tax realization in the baseline year (H1 2021). Tax revenue up to H1 2022 reached a growth rate of 52.3 percent. These two things have leveraged fiscal performance to remain at a surplus.

The surge in state revenue over the past six months indicates that the fiscal space is widening, meaning that the room for the state budget to move towards expansion is more open, so the fiscal discipline is making its way towards achieving a budget deficit of 3 percent of GDP.

The wider fiscal space is also recorded in the decline in the realization of deficit financing through government bonds. From the latest Finance Ministry data up to H1 2022, financing realization through the issuance of debt securities decreased 56.9 percent compared to the same period in 2021. Realization of government securities/SBN (net) in H1 2021 amounted to Rp 464.0 trillion, which fell to Rp 182.4 trillion in SBN realization (net) in H1 2022.

Also read:

> Deficit Financing Becomes a Challenge for Government

> Debt and Fiscal Sustainability

The higher national liquidity is supported by various supporting programs. These include burden sharing with Bank Indonesia, windfall revenue from commodity exports, and tax realization that has exceeded the target since 2021, which have made the fiscal space more flexible. Thus, the role of the State Budget as a shock absorber in the face of the risks of global uncertainty has become increasingly resilient as national liquidity thickens.

Postponing the adjustment of subsidized fuel prices, followed by an additional subsidy quota for the 2022 Revised State Budget, indicates that the fiscal space can still deal with volatile prices and inflationary pressures (inflation volatility). Likewise, spending on social protection (social safety net) saw extra allocation, which illustrates the state budget’s resilience as a backup instrument.

This is a responsive policy in the face of pressures from the global food reference price, which is equal to US$3 worth of energy prices. Again, the State Budget surplus in the first semester of 2022 is additional government ammunition, strengthening the role of the State Budget as a shock absorber.

End of the party

However, as the old saying goes, all parties end: no party lasts forever. As a business cycle, the commodity boom will show signs of slowing down. Along with that, windfall tax, the main driver of state revenue during the pandemic, will enter a downward trend.

The budget surplus and high tax revenue are also a cause for concern. Steady state revenue supported by commodity prices is increasingly leading to a decline in prices. It is undeniable that the decline in global commodity prices will cut into the state budget. This has become a source of concern amidst the government's efforts to consolidate and maintain fiscal discipline.

If we look at the APBN Kita data for July 2022, which was just released by the Finance Minister, the largest tax contribution by sector came from the industrial sector at 29.7 percent, with annual growth of 45.1 percent. The second largest contributor to tax revenue is the trade sector at 23.4 percent, with annual growth of 62.8 percent.

This is followed by the mining sector with a contribution of 9.7 percent and annual growth of 286.8 percent. If global commodity prices continue to decline in line with sluggish global demand, then the state budget will risk collapse as the momentum of windfall revenue dwindles.

Data from Trending Economics released in July 2022 show that four commodity components, namely energy, metals, agriculture and livestock, will experience a general decline in prices until 2023. The food commodity price index of the Food and Agriculture Organization (FAO), for example, continued to show a decline over three consecutive months to 154.2 in June 2022 from an upward revision of 157.9 in May.

Likewise, the price of crude oil, fell from the highest price of $120.07 per barrel in March 2022 to $97,336 per barrel. The price of palm oil, which is Indonesia's mainstay commodity, is also on the radar for its price index decline.

The downward trend in global commodity prices was triggered by increasingly sluggish global demand. This is due to the GDP performance of the world's major economies, such as the United States and several European Union countries, which are edging closer to a recession; likewise China, the king of global manufacturing, whose economic performance is now experiencing a severe slowdown. Stagnant GDP performance and concurrent inflation of above 7 percent in major countries, is undermining global purchasing power and demand.

It should be noted that the global challenges and risks are not over yet. As long as the Covid-19 pandemic has not ended, the conflict between Russia and Ukraine continues, which has caused global supply chains to stall, and major countries maintain their hawkish monetary policies, uncertainty and economic volatility will occur. The so-called external turmoil, or spillover effect, on the domestic economy has the potential to occur. Therefore, the State Budget continues to function as a shock absorber from the various economic shocks mentioned.

Fiscal sustainability must be maintained so the State Budget can be on standby as an instrument to reduce global uncertainty.

Fiscal sustainability

Discretionary fiscal policy requires the government to be discreet in state spending and/or tax revenue. In a recession, fiscal discretion is manifested as a countercyclical policy. Spending is boosted and corporate tax incentives are given. Meanwhile, during GDP expansion, the direction of fiscal discretion tends to be pro-cyclical, fiscal tightening occurs, spending is streamlined, and taxes are raised.

GDP performance has continued to improve to achieve actual growth of 5.01 percent in the first quarter of 2022, which shows that the contracyclical phase has ended.

Assuming that GDP has a monetary value of Rp 18 quadrillion in 2022, tax revenue can actually be boosted higher, along with the size of the economic pie (GDP). However, efforts to maximize tax revenue are still slow in a narrow sense, with the tax-to-GDP ratio stagnating below 10 percent (single digit).

Also read:

> Fiscal Priority: Between ‘Must’ and ‘Want’

In the Revenue Statistics in Asia and the Pacific 2022 report from the Organisation for Economic Co-operation and Development (OECD), Indonesia's tax-to-GDP ratio is ranked among the countries with the lowest tax ratio, or 29th out of 32 countries. Indonesia's tax ratio fell 1.5 percentage points from 11.6 percent in 2019 to 10.1 percent in 2020. From 2007 to 2020, Indonesia's tax-to-GDP ratio fell 2.1 percentage points from 12.2 percent to 10.1 percent. The highest tax ratio occurred in 2008 at 13.0 percent, with the lowest at 9.7 percent in 2022.

With a tax ratio of 9.7 percent, the monetary value of GDP of Rp 18 quadrillion only contributed Rp 1.75 quadrillion. Thus, the large economic pie contributed only a small share to tax revenue relative to the monetary value of GDP. This means that potential tax revenue is still a source for maintaining fiscal sustainability after the commodity boom ends.

Difficult to tax

One of the reasons it is difficult to leverage the tax ratio is that several sectors that contribute greatly to GDP are classified as “hard to tax”. These include the agriculture and micro, small and medium enterprise (MSME) sectors. The MSME sector, for example, despite contributing over 50 percent to GDP, is included in the “hard to tax” sectors.

In 2021, for example, data from the Finance Ministry’s Taxation Directorate General showed that the final income tax (PPh) contribution from MSMEs amounted to Rp 2 trillion. This is equivalent to the agriculture sector, which contributed just 1 percent to the total tax revenue of Rp 1.278 quadrillion in 2021. In fact, according to data from Statistics Indonesia (BPS), the agriculture sector was the third largest contributor to GDP in 2021 at 11.39 percent.

The agriculture sector is difficult to tax because the industry actors are micro-small enterprises and the informal sector, or farm workers, whose average wages remain below the nontaxable income limit (PTKP).

This low tax contribution from the agriculture sector is due to the facilities provided by the government, such as the value-added tax (PPN) exemption and the option to determine the tax base on other values, such as the delivery of certain agricultural products. Under Law No. 7/2021 on harmonization of tax regulations (UU HPP), tax reform in the agriculture sector needs to be addressed so that the sources of tax revenue in the agriculture sector can be optimized.

According to this author, fiscal sustainability can be achieved if the HPP Law as a new instrument in organizing the tax system is able to explore tax sources from the two sectors that dominate the national economic structure, namely the MSME and agriculture sectors.

In the July 2022 statement on the APBN, the four GDP sectors that contribute the largest share to tax revenue are the manufacturing, trade, financial services and insurance, and mining sectors. This shows that the largest share of GDP has not contributed significantly to state revenue. This is also the reason our tax ratio remains stagnant in the single digits.

Another thing that needs to be improved is Indonesia's nontaxable income (PTKP) baseline, which is still high compared to neighboring countries.

What George Bernard Shaw said is worth pondering: “Taxes are the chief business of a conqueror of the world.”

If we look at Law No. 7/2021 on the HPP, the nontaxable income (PTKP) for individuals is still Rp 54 million per year, or Rp 4.5 million per month. This is the same as the amount of PTKP regulated in the Income Tax Law (UU PPh). In contrast, the PTKP baseline in Malaysia is Rp 28 million per year. A higher PTKP baseline means that the tax base is lower, or fewer taxpayers.

The average regional minimum wage in Indonesia, which is still low and below the PTKP baseline, shows that the tax base achieved by the state is not yet optimal. The same thing also happened to the corporate taxable income (PPKP) baseline of Rp 4.8 billion per year in the HPP Law, which is still higher than that in neighboring countries like Malaysia and Vietnam.

To create fiscal sustainability, the main sources of state revenue, such as taxes, must be reformed. This includes modernizing the tax system to make it simpler and more integrated, and increasing public literacy in an effort to raise taxpayer awareness.

Following the surge in state revenue due to the commodity boom (windfall resettlement), the challenges of fiscal consolidation and sustainability lie ahead. There is no other choice but to continue to reform the main sources of state revenue. This is the only certainty in maintaining fiscal sustainability. What George Bernard Shaw said is worth pondering: “Taxes are the chief business of a conqueror of the world.”

Abdul Munir Sara, Expert staffer to a member of House of Representatives Commission XI

This article was translated by Kurniawan Siswo.