“Taper Tantrum” Threatens Economic Recovery

Valuable lessons from the US more or less indicate that the success of the vaccination program is one of the key factors in the economic recovery of the superpower.

Lately, there has been a lengthy discussion regarding the potential emergence of a "taper tantrum" phenomenon as the impact of the United States\' monetary policy in the near future.

The term “taper tantrum” became popular in 2013 when the chairman of the United States’ Federal Reserve (the Fed) tried to ease the expansionary monetary policy following recovery in the country’s economy. Previously, the expansionary monetary policy was carried out through quantitative easing, by channeling more liquidity into the market through the purchases of bonds issued by the US government.

The additional liquidity was very much needed to boost the US economy which had been in contraction in the previous few years. However, as the economy began to recover and to prevent overheating or excessive inflation, the Fed considered it necessary to step on the brake pedal by gradually reducing the quantitative easing.

Such a measure was needed because in order to reduce the expansionary monetary policy, the Fed had to raise its benchmark interest rate so that some of the liquidity could be withdrawn into the monetary system through the banking system. Inevitably, the taper tantrum had a domino effect on the global economy.

Also read:

The bond market was disrupted due to volatility occurring not only in developed countries, but also in a number of developing countries. The change in the policy resulted in a “taper tantrum”, among other things, due to the decline in the price of debt securities in the global market, which caused a spike in the yields of the securities.

A study conducted by Estrada, Park and Ramayandi (2015) showed that the bond or stock market was greatly affected by the taper tantrum phenomenon. The exchange rate of several global currencies sharply depreciated against the US dollar.

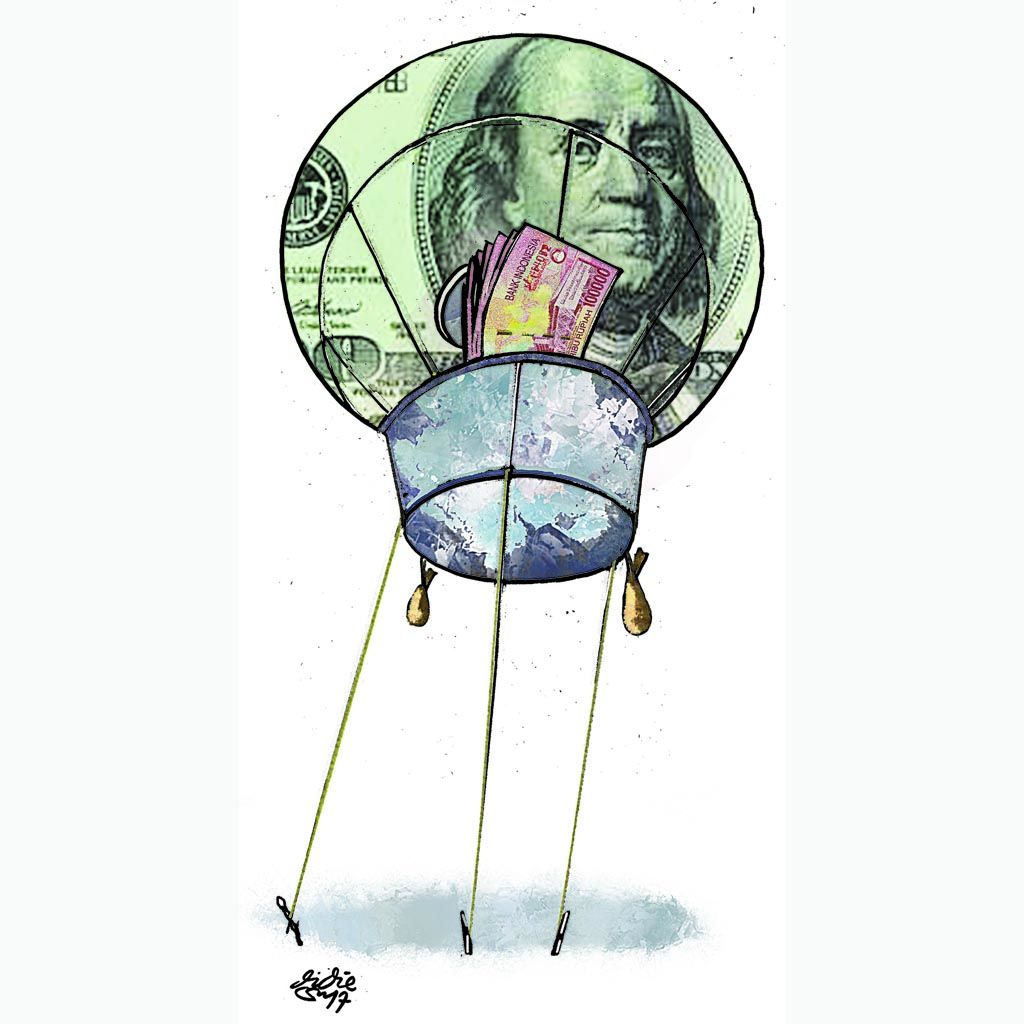

Another frightening impact was the reversal of capital flows to these superpowers. The capital outflows from developing countries could not be avoided.

The widespread impact of the taper tantrum was very powerful and occurred in almost all countries, considering that global economic connectivity between one country and another no longer had a limit.

Such a state of affairs greatly affected the economies of developing countries, especially in countries that were included in the emerging market group, such as Brazil, India, South Africa, Turkey and Indonesia. For Indonesia, the taper tantrum that occurred in mid-2013 also had a severe impact, even though the Indonesian economy itself was in good condition at that time.

At that time, Indonesia\'s economic growth was in the range of 5-6 percent, but still did not have enough immunity in facing the taper tantrum phenomenon.

At the time, the taper tantrum caused a decline in the rupiah exchange rate from Rp 9,790 to Rp 14,730 per US dollar (down 50.4 percent) , while the Jakarta Composite Index (JCI), the main price index on the Indonesia Stock Exchange (IDX) also suffered a 23.3 percent decline from 5,207 to 3,967.

These facts indicate that there is no guarantee that even if our economy is in a positive and rapidly growing condition, we can avoid the impact of the taper tantrum.

Potential for taper tantrum 2.0

The Covid-19 pandemic that has occurred in almost all countries has forced their central banks to implement expansionary monetary policies to support economic recovery such as by lowering the benchmark interest rate and purchasing debt securities.

A year after the emergence of the Covid-19 pandemic, a number of countries have already showed signs of economic recovery, even faster than expected, such as the United States, China, Australia, Hong Kong and Taiwan. The recovery is reflected in an increase in economic growth and a rise in the monthly inflation rate. It means that the expansionary monetary policy may need to be gradually eased.

Also read:

The US as the center of the global economy recorded economic growth of 6.4 percent year-on-year (yoy) in the first quarter of 2021. Economic growth is projected to further increase to 8.6 percent in the second quarter of 2021.

The inflation rate in April 2021 even reached 4.2 percent (yoy), a reflection of the rising level of household spending in the midst of the ongoing pandemic .

The rapid economic recovery in major countries was caused by three factors, namely the success of the economic stimulus package, large spending on infrastructure, and the success of the vaccination program. Therefore, if the Fed steps on the brake pedal on its expansionary monetary policy, it is feared that it will have a major impact on countries that are currently still experiencing an economic recession, including Indonesia.

Economic observers are divided regarding the prediction of the emergence of the second taper tantrum. On the one hand, economists say the potential for the second taper tantrum is very small at this point in time due to a number of reasons.

First, the current global economic fundamentals are stronger than the global economic condition in 2013. The economic fundamentals of developed countries or emerging markets, including Indonesia, are currently also more solid than the situation in 2013.

Second, the Fed has certainly learned a lot from the 2013 experience that the policy to halt its quantitative easing policy should not be implemented too drastically and should be carried out gradually. The goal is quite obvious, to prevent financial shocks that could occur in global financial markets.

Third, there is confidence from investors that a number of countries have already prepared powerful instruments and policies to overcome the possible emergence of the second taper tantrum.

However, on the other hand, some economists think that other taper tantrums may still occur in the current pandemic era, based on several arguments.

Also read:

> Why Indonesia Must Recover Faster

First, the faster-than-expected economic recovery, especially in several developed countries such as the US, can encourage them to immediately change their expansionary monetary policies. The change in monetary policy of the superpowers may have a systemic impact on almost all countries.

Expansive monetary policies to be implemented during the pandemic must fulfill the 3T elements, namely timely, targeted and temporary.

This means the government should introduce the policy at the right time, with a clear target, and it should be of a temporary nature. If the economy has begun to gradually recover, the expansionary monetary policy must be eased to prevent the economy from overheating and inflationary pressure.

Second, there are currently many developing countries or emerging markets that have not yet emerged from the recession, so most of them still rely on expansionary monetary policy, either through quantitative easing or low interest rates.

With the tightening of the liquidity, the interest rate disparity between developed countries that have recovered from recession and developing countries that are still struggling to cope with the recession will become wider. As a result, capital outflows from developing countries can become more intense, disrupting the economic recovery process of these countries.

.

Third, the condition in 2021 is very different from 2013, when there was no health crisis as a result of the Covid-19 pandemic. One of the efforts to overcome the Covid-19 pandemic is conducting a vaccination program to achieve herd immunity.

The sooner herd immunity is achieved, of course, the easier the global and national economic recovery can be realized. However, not all countries get equal opportunity for vaccination considering that most of the available vaccines are still in the hands of developed countries where the vaccine producers are located.

Without equitable distribution of Covid-19 vaccines, the economic recovery of developing countries will become increasingly difficult, while the economies of developed countries will accelerate even faster. With the realization of community immunity, the economic recovery of developed countries will be faster and this will encourage them to gradually ease the expansionary monetary policies by tightening the liquidity.

Impact on Indonesia

If the taper tantrum occurs again, it is not impossible that its impact will also spread to other countries, including Indonesia. The emergence of another taper tantrum will potentially cause some turmoil or disturbance.

First, it is possible that the rupiah exchange rate will depreciate, like in 2013, but it is difficult to predict how low it will decline. The depreciation of the rupiah will certainly hit investment and business activities, especially those financed by foreign currencies.

Second, the stock price index will of course also experience considerable pressure because foreign investors holding local bonds and stocks may sell them. It means the existing foreign funds have the potential to flow back to their countries.

Third, the cost of issuing debt securities, both government bonds and private bonds, will become more expensive because the issuers of the debt securities must provide higher yields in order to maintain a competitive interest rate differential as a result of the rising benchmark interest rates in developed countries.

Fourth, an increase in the benchmark interest rate that can be taken to cope with the impact of the taper tantrum will hit banks’ intermediation functions as the credit interest rates should also be increased. This condition could disrupt efforts to recover the national economy considering that the current demand for bank credit is still far from expectation, even though bank credit is one of the drivers of the economic recovery.

Alert level 1

We hope that taper tantrums will not happen again in 2021, but no one can guarantee that the ghost of the taper tantrum will not return again.

Therefore, from an early stage, we need to anticipate it by introducing alert level 1, namely by preparing various policies that may be needed if a taper tantrum really occurs again.

Preparing an anticipatory policy in an early stage is needed to deal with the domino effect of the taper tantrum so that we have enough time to introduce responsive and accommodative policies to face it.

In order to prevent the domino effect of the taper tantrum, of course, Bank Indonesia should also anticipate it and make some adjustments related to the loose expansionary monetary policy that has so far been implemented.

Also read:

> Economic Recovery and Partiality

> Recession During Pandemic and Economic Recovery

It is possible that expansionary monetary policy will gradually turn into a contractionary monetary policy to reduce the liquidity in the market. The benchmark interest rate, which has so far been very low, may be gradually increased again so that it can slow down credit distribution, which remains weak.

Another burden is the possibility of increasing intervention costs to maintain the rupiah exchange rate in a stable range.

The macroprudential policy should be continued to maintain household spending, which has so far been the engine of national economic growth. All of these policies are urgently needed to strengthen Indonesia\'s macro-economic fundamentals so they are able to get out of the recession or anticipate the threat of another taper tantrum.

Hopefully, the Indonesian economy in the second quarter of 2021 will grow so that we can get out of the recession path and the impact of the taper tantrum can be reduced as much as possible.

Agus Sugiarto_

In addition, the current national vaccination program needs to be accelerated to support the national economic recovery. Valuable lessons from the US more or less indicate that the success of the vaccination program is one of the key factors in the economic recovery of the superpower.

Agus Sugiarto, Head of the Financial Services Authority (OJK) Institute

This article was translated by Hendarsyah Tarmizi.