Economic Recovery Moves on

The economic recovery is evidently taking place. The question is how strong it is. It looks quite strong at the macro level, but at the micro level?

The economic recovery at the global level is being spearheaded by the two largest economies – the United States and China.

The US recorded 7.4 percent of growth and China 18.3 percent growth in the first quarter of 2021. Both were very aggressive in fiscal and monetary policies to stimulate the economy. However, high commodity prices and abundant liquidity with a strong economic recovery led to increased inflation.

Inflation in the US in April reached 4.2 percent, much higher than what many had expected. Even so, the US Federal Reserve (the Fed) considered the inflation transitory and believed it would fall back, so there was no need to raise interest rates.

Also read:

> Economic Growth toward the End of the Pandemic

However, many investors had a different opinion, saying that inflation would remain high and persistent and that the Fed would start tapering off and raising interest rates earlier than originally expected.

Meanwhile, China strived to overcome the prospect of default by large companies while inflation also showed an upward trend.

These two countries have also managed to cope well with the pandemic, which provides high trust for consumers and producers. China, where the COVID-19 pandemic started, initially took aggressive measures over social restrictions. The US experienced a worse pandemic before ramping up a vaccination rollout and managing to control it.

How strong is the recovery?

The performance of the two largest economies has had a major impact on other countries, including Indonesia. Economic recovery has occurred unevenly in many countries. The Indonesian economy itself in the first quarter was still experiencing contraction, declining by 0.74 percent, but it is expected to have high growth in the second quarter, the period in which it suffered the deepest economic contraction last year. In general, this year\'s growth estimate is around 4 percent, while the government still hopes for around 5 percent.

The signs of economic recovery are strong, with the consumer confidence index at 101 and the PMI, as a measure of manufacturing industry activity, already high at 56.3. Electricity consumption at the end of April also increased even further from 2020 and 2019.

Also read: Recession During Pandemic and Economic Recovery

Credit growth contracted by 3.7 percent on an annual basis in April, although it was positive on a monthly basis. Bank credit greatly determines economic growth.

Hopes are abound that, starting in May, credit growth will be positive and continue to grow high enough to facilitate economic growth.

However, banks still have to face serious credit restructuring. Several banks, especially in Book III, began to incur high non-performing loans at a rate of over 4 percent.

With borrowers’ balance sheets still weak, banks will be highly reserved about extending larger loans. This is the main obstacle to promoting economic growth during the recovery period.

In other words, the entanglement between creditors and borrowers is not strong enough to encourage high growth.

Consumption as a driver

Even though consumption contracted in the first quarter, the trend showed signs of improvement. Luxury Goods Sales Tax (PPnBm) exemptions for car sales have encouraged high demand.

Consumers hope the move to provide PPnBM exemptions in housing, which had yet to have a strong impact as of August, can further stimulate home purchases.

Also read: Spring Comes to Economic Recovery

The PPnBM exemption has also helped improve the cash flow of borrowing companies. However, the government\'s plan to increase Value Added Tax (PPN) to cover the shortage of state revenue is eliciting serious concerns about restoring public consumption.

Raise taxes or debt

On the one hand, efforts to increase tax revenue must be made to cover the budget deficit. On the other hand, stimulation to increase consumption through a reduction or exemption of PPN is still expected by consumers and producers in order to improve their financial condition through sales increases.

This comes down to how the government must overhaul the deficit of more than 5 percent of gross domestic product (GDP) to bring it below 3 percent, as planned, by 2023.

In fact, with a budget deficit of around 5 percent and the economic recovery not looking as strong as expected, the stimulus is still needed.

/https%3A%2F%2Fkompas.id%2Fwp-content%2Fuploads%2F2018%2F06%2F20180610_ENGLISH-OPINI_A__web.jpg)

.

The problem, of course, is that the debt is getting bigger against the deficit. With a debt ratio of around 41 percent of GDP, it is actually still under control. So are the interest for bonds and yields.

The important thing is that debt management improve to keep bond prices in check and repayments, as well principal debt, well on track. Bank Indonesia (BI) should no longer be asked to "print money" to finance the deficit in order to maintain its credibility.

The Fed is likely to carry out bond purchase reduction (tapering) and raise interest rates earlier, which will bring serious implications to the Indonesian economy.

Also read: Stimulus to Lift the Economy

With the trend of increasing domestic inflation, BI is likely to adjust the policy on interest rates. The implication is, of course, quite serious when borrowers have to pay higher interest and loans, while the economic recovery is not yet performing enough.

For BI, the options are to anticipate inflation by raising interest rates early, which means holding back the flow of economic recovery, or raising interest rates after inflation has increased significantly with the risk of it being more difficult to cope with.

Investment as foundation

Even though investment still declined annually in the first quarter, the trend showed an improvement. The Job Creation Law has allowed investment to grow despite the tough challenges in its implementation, as in the opposition to the entry of foreign workers (TKA).

Rejection by several circles has flared up over the entry of Chinese workers, even though the country is the most enthusiastic investor in Indonesia.

With the pandemic measures forcing the limitation of foreign worker mobility, foreign companies are at the moment unable to bring in their experts. Labor unions strongly object to the Job Creation Law.

Also read: Recovery Program Should Target the People

The regions also appear reluctant to implement the Job Creation Law further because of indications of recentralization. While a better tax incentive is urgent for the investment plan, the issue of tax increase – with aggressiveness in the part of tax workers ensuing – is becoming a serious concern for investors.

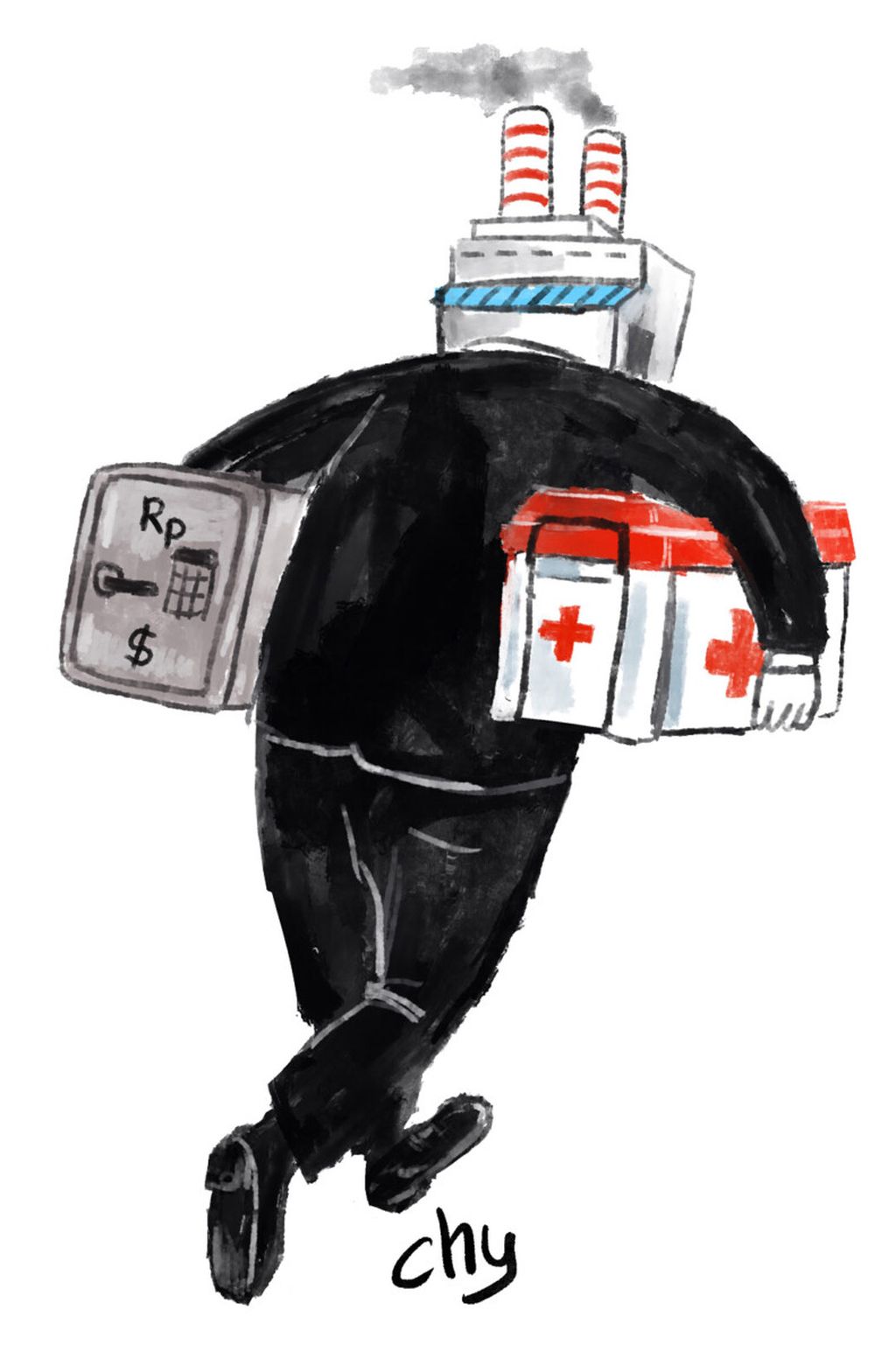

Didie SW

Vaccination optimization

Indonesia opted from the beginning against a lockdown in dealing with the pandemic. It has instead implemented social restrictions while looking to roll out an expansive vaccination program.

However, because of the difficulty of procuring supplies, despite the progress, the vaccination program might not reach the target of 70 percent of the population this year. This will certainly affect the economic recovery.

Consumers, especially those at high or middle income levels, are ready to spend, while low-income consumers are becoming dependent on government cash assistance.

A strong economic recovery requires success in coping with the spread of COVID-19. With the limited supply of vaccines and social restrictions still being rather ineffective, a resurgent pandemic wave remains possible. This, of course, would impede the economic recovery.

The economic recovery is evidently taking place. The question is how strong it is. It looks quite strong at the macro level, but at the micro level, it remains to be seen how companies and consumers, as recovery determiners, will perform.

Also read: 2021: Between Pandemic and Economic Recovery

Consumers, especially those at high or middle income levels, are ready to spend, while low-income consumers are becoming dependent on government cash assistance.

Companies are still struggling with weak balance sheets that make it difficult to get bank credit. The increase in demand will help improve the cash flow greatly, which in turn will increase access to bank credit.

/https%3A%2F%2Fkompas.id%2Fwp-content%2Fuploads%2F2020%2F08%2Fumar_1597194231.jpeg)

Umar Juoro

Banks, although they still have to face credit restructuring with large liquidity because of the pandemic, are actually ready to channel large amounts of credit as long as borrowers show improvements on their balance sheets. These are the dynamics of the economy and business that define how strong the economic recovery will continue to be.

Umar Juoro, Senior Fellow at The Habibie Center.

This article was translated by Musthofid.