The Fiscal Room for Stimulus

Indonesia can still afford to provide additional 10 percent of its gross domestic product to assist people who have lost their jobs and earnings due to the Covid-19 pandemic.

Indonesia can still afford to provide additional 10 percent of its gross domestic product to assist people who have lost their jobs and earnings due to the Covid-19 pandemic.

This extra stimulus will raise the government’s fiscal deficit to 15 percent or above the present target of 5 percent, without causing inflation or rupiah exchange rate depreciation or mounting debts that are hard to manage.

With this bigger deficit, an emergency fund will be available to reduce the impact of the Covid-19 pandemic on low-income people. We make the conclusion in a book to be published this year by Anthem Press, entitled Jalur yang Menyempit Menuju Kemakmuran dan Pengentasan Kemiskinan di Indonesia (on the path toward Indonesia’s prosperity and poverty relief).

Moral reason

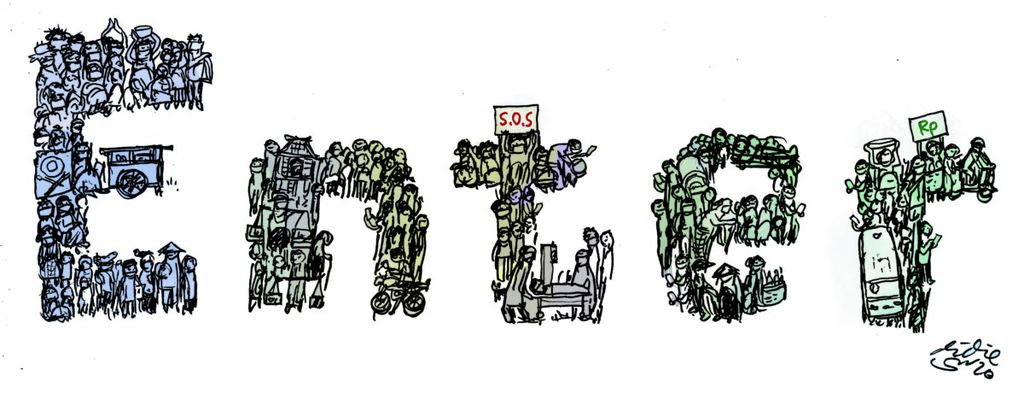

More than 5 million workers have lost their jobs in the formal sector as a result of large-scale social restrictions (PSBB), which forced many businesses to close down. Only half of their income is left or it’s even totally spent.

Two million other workers have joined the workforce. The seven million people are facing a bitter reality caused by Covid-19 and the ensuing economic slowdown.

Owing to moral, economic and political reasons, the government should relieve the blow suffered by the worst off. However, the government’s income has also decreased and for decades the GDP deficit has been limited to a maximum of 3 percent.

Also read: An Opportunity to Make Islamic Financial Products More Accessible

One of the biggest reasons for restricting the deficit is the fear of inflation. But the measures already taken to control the coronavirus have caused a recession. The problem is the lack of demand, not over-demand. A rise in demand will increase supply, not inflation of prices.

Our model indicates that the PSBB has induced “forced saving”, something that is not considered in the other models. Many people are confined to their homes. They cannot spend as much as usual on dining out, going to the movies, traveling, or even going to places of work.

Also read: Recycling of NTT Weaving Economy

Entrepreneurs and the government cannot execute their investment plans. Income is saved so that it reduces demand, at the same time creating an accumulation of resources that can finance the government’s bigger deficit.

Online ojek (motorcycle taxi) drivers line up to buy food at an eatery in Tebet, South Jakarta, on Nov. 2, 2019 (2/11/2019). The culinary business has greatly benefited from the digital economy. According to the Communications and Information Ministry, 9.62 million micro, small and medium enterprises that took their business online in 2017-2018.

The second source of deficit financing is the growth of government income from the GDP increase generated by subsidies. Families receiving government subsidies will spend most of the aid on food and other basic necessities. This will raise the income of businesses and individuals producing and selling the commodities.

The companies and individuals in turn spend their money on goods and services so that another round of income and expenditure follows.

We estimate that this indirect or multiplier effect will influence government spending to the extent of 1.6 to 1.8 times its original expenditure. In line with this, the government collects taxes form the additional economic activity.

Dr M Chatib Basri, the Indonesian Finance Minister of the 2013-2014 term, has spotlighted in this daily the third source of the “fiscal room,” which comes from the pandemic-push reduction of other government expenses already budgeted, such as those for international tours and public investments.

Our model shows that the government’s fiscal deficit can reach 23 percent before the emergence of inflation pressure and the balance of payments becomes negative. Even the minimum PSBB strategy like that implemented by the government today can lower national income and consumption.

Indonesia’s GDP is approximately US$1 trillion per year or US$250 million per quarter. We reckon there are now 140 million people who are disadvantaged or need assistance. This total is an appropriate assumption in view of the collapse of the hotel industry, the export slump and economic recession in general.

Our model also shows that this will happen, at the same time capable of increasing the amount of foreign exchange reserves.

At the rate of 10 percent subsidies, each of those needing aid can receive the equivalent of US$1.94 per day. The 10 percent subsidies can be fully financed from the forced saving due to the PSBB, along with the rising GDP caused by the subsidies themselves. Our model also shows that this will happen, at the same time capable of increasing the amount of foreign exchange reserves.

Also read: Surviving with Collaboration and Innovation

Millions of people became unemployed nine months ago. It means that it’s very important to disburse the subsidies as soon as possible.

Fintech support

Financial technology (fintech) offers the way to realize this. There are more than 193 million cellphones in Indonesia, equivalent to one cellphone for every adult. All of them can receive money.

/https%3A%2F%2Fkompas.id%2Fwp-content%2Fuploads%2F2018%2F06%2F20180618_ENGLISH-PANTURA_A_web.jpg)

Signs still hang in front of a closed salted egg shop on Wednesday (13/6/2018) along the northern coastal road (Pantura) in Brebes regency, Central Java. The shops started closing last year when part of the Trans-Java toll road opened. Micro, small and medium enterprises (MSMEs) along Pantura, such as the salted egg businesses, went bankrupt when motorists switched to the toll road.

The fastest method for the government to provide the subsidies is to open digital bank accounts at Bank Rakyat Indonesia for all cellphone owners. The government can then pay up the subsidies to the digital bank accounts by spending the least cost and ensuring minimum delay.

As most citizens of Indonesia possess cellphones, they can make mutual payments without needing many points to spend cash.

Technology can be used to determine the “whereabouts” of cellphones by benefiting from data on the use of cellphone towers collected by telecommunication companies. This information can function to match cellphone owners with their addresses, even if the registered cellphone owners live in other places.

Therefore, the subsidies can be directed at cellphone users living in regions that are mostly inhabited by disadvantaged communities.

Small subsidies, such as aid for four days, will be delivered to the addresses. In order to obtain further disbursements, recipients are required to enter their identity card (KTP) numbers into their cellphones so as to avoid payment duplication.

Also read: Collaboration for Revival in 2021

For the avoidance of identity theft, we will need additional information only known by the KTP holders, like birth dates and KTP issue dates. It means that the government needs to launch an emergency program to issue KTPs to a large number of poor people still without identity cards.

At around US$2 per person per day, one typical family with two adult members owning cellphones will get about US$120 per month. This is still below the poverty line in Indonesia, which is USS150 per family per month.

/https%3A%2F%2Fkompas.id%2Fwp-content%2Fuploads%2F2020%2F07%2F20200723ZAK08_1595514797.jpg)

A woman arranges a display of locally produced coffee on Thursday (23/7/2020) at a business meeting on micro, small and medium enterprises (MSMEs) in Mataram, West Nusa Tenggara (NTB). Local MSMEs have developed superior products from the NTB administration’s economic assistance for earthquake-affected communities. Today, MSMEs in Lombok have said they have been encouraged by the transition to the “new normal” phase of the Covid-19 mitigation measures.

Some improvements can be made in the context of the use of artificial intelligence as already described, such as the frequency and time of use, the connection to towers in low-income communities’ regions, and the correlation with information about poor communities already available, including data from household surveys.

Even with this method, some poor communities won’t receive subsidies and some of those better off will do. Nevertheless, the big advantage in administration and the speed achieved by the use of financial technology and big data are more than enough to compensate for the target errors.

Indonesia owns the resources needed to assist disadvantaged communities in going through this difficult period and has the methods to provide the aid. Everybody, even those who are not poor, will gain benefits from more rapid economic growth. Now is the right time to take action.

Gustav Papanek

Gustav Papanek, Emeritus Professor of Economics, Boston University; President, Boston Institute for Developing Economies (BIDE)

(This article was translated by Aris Prawira)