Economic Stimulus Exit Strategy

This article may seem awkward. It may be too early to discuss this subject, but it will be too late if we don\'t prepare now.

This article may seem awkward. It may be too early to discuss this subject, but it will be too late if we don\'t prepare now. What I\'m talking about here is an exit strategy from the economic stimulus that has been implemented to support the economy. We know that the economic crisis triggered by the Covid-19 pandemic has forced governments and central banks around the world to launch stimulus policies. Do whatever it takes to save lives and the economy! Perhaps that is the theme of the economic policy in the world today.

In Indonesia, the economic stimulus introduced to support the National Economic Recovery (PEN) program caused an increased in the budget deficit to about 6 percent of gross domestic product (GDP) in 2020. Bank Indonesia (BI) has lowered the interest rate and minimum reserve requirement (GWM), as well as offered a burden sharing program with the government, while the Financial Services Authority (OJK) has issued a debt payment relaxation program. In the United States (US), Singapore and Australia, budget deficits have even increased to 10 percent of GDP or more. In some countries, the focus is on health, social protection and assistance to micro, small and medium scale enterprises (MSMEs).

When should it end?

Stimulus is very important. However, it cannot be given forever. I remember a statement made by the former US Treasury Secretary who is also a professor at Harvard Kennedy School, Larry Sumers: The stimulus policy, especially fiscal, has triple T characteristics (timely, temporary, and target). Therefore, all of these stimulus policies have a time frame. The question is when should it end? What is the right exit strategy that will not bring a negative impact on the economy?

To answer this question, there are several things that need to be considered. First, the government is likely only to reduce fiscal stimulus if private consumption and private investment have begun to recover. Unfortunately, as I wrote in this daily (16/12/2020), I am not sure that private consumption and investment will fully recover in 2021. The reason is: as long as the pandemic has not been resolved, the consumption of the upper middle class — which makes up the largest share of household consumption — will not return back to normal.

Also read: 2021: Between Pandemic and Economic Recovery

Their consumption baskets are dominated by spending for entertainment, travel, and durable goods, such as cars or houses. We know purchasing of durable goods is cyclical. It is impossible for people to buy a car or a house every month. Meanwhile, entertainment and travel activities have practically stopped or been disrupted due to the pandemic.

From the investment side, the decline in the people’s mobility due to the pandemic has limited economies of scale. As long as the economy cannot fully operate, private investment will not increase sharply. Indeed, there is hope from exports thanks to increase in coal and palm oil prices. However, their impact is somewhat limited. In a situation like this, the government budget remains the key.

If health problems can be resolved, there is a hope that the fiscal stimulus can be reduced in 2022. The problem is that it cannot be done drastically. We know, starting in the middle of this year, the government must sit down with the House of Representatives (DPR) to discuss the 2022 Draft State Budget. And we know, Law No. 2/2020 stipulate the budget deficit must return to below 3 percent by 2023.

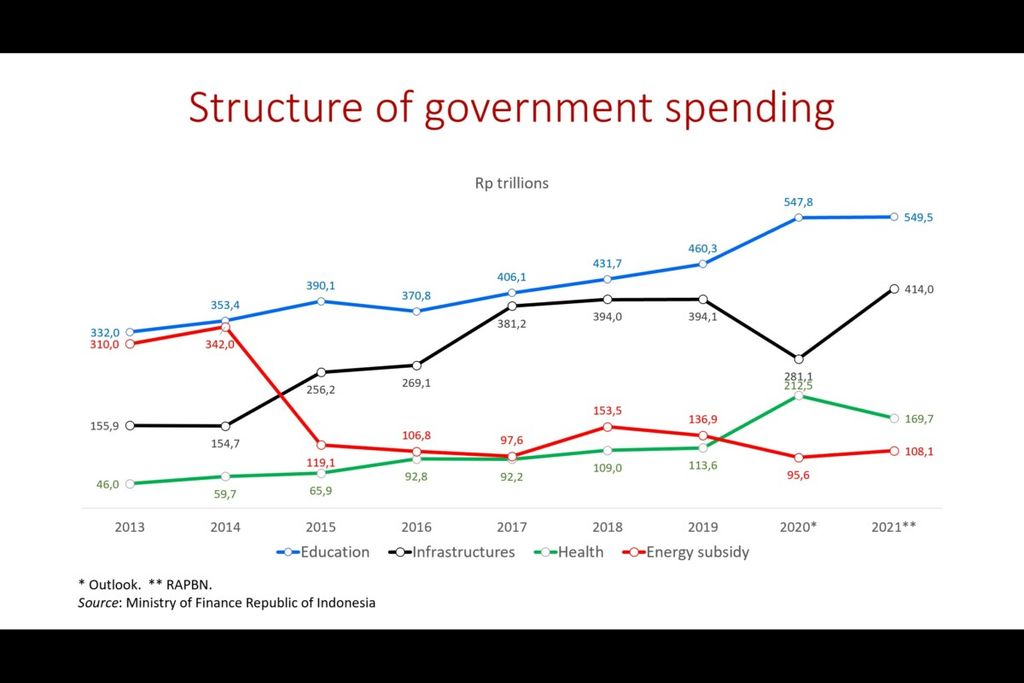

Government projections in the Macroeconomic Framework and Principles of Fiscal Policy in 2021 show that tax revenues will be in the range of 8.4-9.1 percent of GDP in 2023. On the one hand, the ratio of debt to GDP will range from 36.5 to 37. 4 percent. The implication is that the expense for debt interest payment will increase. On the other hand, there is a mandatory spending that the government must undertake, such as education funds (20 percent) of total spending, and transfer funds to regions (around 30 percent of total expenditure). The implication: the cut-off space for spending is very limited

Also read: Welcoming the Year 2021

If tax revenue cannot be increased by 2023 in order to reduce the budget deficit to below 3 percent, the government must cut various expenditures, including productive and social assistance expenditures. If this is done drastically, the economy will contract. If the private sector has not recovered and government policies are pro-cyclical (following economic cycles), the economic recovery will be slow. As a result: the debt-to-GDP ratio will increase due to weak GDP growth.

Chan-Lau and Zhao (2020) in their article in the IMF Working Paper show that financial markets will react negatively if the government withdraws its stimulus too quickly, namely when the number of daily Covid-19 cases is still high. In fact, even though the pandemic has been overcome, it is necessary to anticipate the impact of trauma which may slow down the recovery process. In addition, if the stimulus is withdrawn too early, there will be a negative impact on the lower middle class and MSMEs. The analogy is: do not withdraw the stimulus when the economy is not out of the woods yet.

I suggest that the government design its fiscal policy by looking at the development of the situation or data dependency. The reduction in the budget deficit is carried out according to economic condition. In this condition, efforts to improve tax revenues by reforming tax administration are important. I see a little chance of increasing tax revenue in 2021 as the impact of the increase in coal and palm oil prices.

Also read: Indonesian Economy After Vaccination

In addition, improving the quality of spending to productive sectors is very important. It is very important for the government to sharpen priorities.

For me, the focus of budget allocations must be more pro-equity, for example by giving priority to infrastructure and digital literacy to address digital inequality; investment in vocational education to upgrade skills and retrain skills; access to health, especially related to the Covid-19 vaccine; and improving the social protection system.

Trend of global stock market movements in January 2021

Second, Nobel laureate in economics Milton Friedman once wrote: inflation is caused by too much money chasing after too few goods. Then why the budget deficit financing through BI’s burden sharing, which will increase the money supply, will not cause inflation? Fried man\'s argument is correct in assuming that the economy is not in a recession and people are spending money.

Former deputy governor of the Australian Central Bank Stephen Grenville has reminded me: nowadays, people keep money in banks. Here\'s how easy it is: BI purchases of government debt papers (SUN) will indeed increase base money. The money is then used by the government for the PEN program and so on.

Also read: Post-Pandemic Economy

This will increase the money supply and boost the economy. But don\'t forget, there\'s a part that isn\'t spent. The unused money is deposited in the bank. Because the economic situation is still weak, people\'s needs, including those of companies, are limited. As a result the money is saved instead of being spent.

Because of this, third party funds have actually increased. As a result, the cash surplus generated from the budget deficit payment returned to the banking sector in the form of deposits. In this condition, BI\'s program to finance part of the budget deficit does not cause inflation. Data shows that base money (M0) has actually grown negative since the fourth week of May 2020 due to negative government net claims.

Also read: Recession and Economic Turnaround

The reason: as of June 2020, the government has not spent much of its money. The net bill on the government returned to positive when the government started spending its money in early July 2020, but until the second week of December 2020, M0 growth was still negative.

Normalization of monetary policy

From this point of view, we don\'t need to worry about inflation. However, when demand starts to recover, BI must also prepare an exit strategy. Inflation will emerge in a few years if it is not careful. BI burden sharing is the right step if it is carried out within a definite and limited time frame.

In addition, when most countries "print money", such a policy is acceptable to financial markets. However, the situation will be different when the economy starts to recover. At one point BI must consolidate its balance sheet. The implication is that normalization through a tight monetary policy cannot be avoided. If this coincides with an effort to reduce the budget deficit, the economy will take a hit just as it begins to recover.

We also know that when the budget deficit increases, BI and banks buy government bonds. When normalization is carried out, BI and banks must reverse or unwind the existing strategy. Currently, there is no crowding out due to abundant liquidity. The loan to deposit ratio has actually decreased due to weak credit demand. However, when a reversal occurs, and credit expansion begins, the risk of tight liquidity may arise.

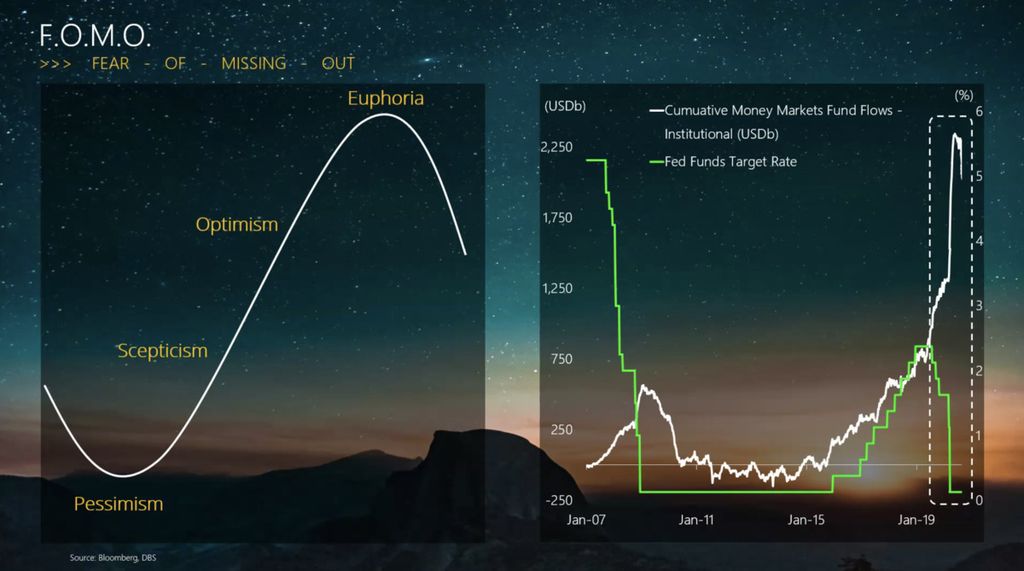

Third, we also need to anticipate the exit strategies implemented by other countries, especially the US. As long as other countries are still implementing quantitative easing (QE), foreign funds will still flow to

Indonesia and the exchange rate stability can be maintained. However, one day the US must also end its QE, maybe in three years from now. Here, we are racing against time. The government must be able to overcome this pandemic before most other countries recover and normalize their policies. If we are late, the government and BI policy space will be very limited.

Look at the experience when the Fed decided to end QE in 2013 by reducing purchases of government bonds and financial assets. As a result, there was a panic known as the taper tantrum, in which the flow of capital returned to the US. Emerging economies (EM), including Indonesia, India, South Africa, Turkey and Brazil, were affected.

Also read: Acceleration through the National Economic Recovery (PEN) 2021 Stimulus

Indonesia and India managed to overcome this situation relatively well with a combination of expenditure reducing policies (reducing the budget deficit through reducing fuel subsidies, and raising interest rates to reduce investment) and implementing expenditure switching policies by allowing the exchange rate to follow the market. The same thing was done by Indonesia in 2018 when the Fed began to raise interest rates.

In three years from now, we may have to anticipate the capital outflow— especially from the bond market — and exchange rate pressures if the Fed normalizes its monetary policy. Unfortunately, I don\'t see the old 2013 and 2018 recipes will be able to fix it. The reason: we need fiscal and monetary expansion when the economy is just starting to recover, and not stabilization. Ironically, without financial markets, particularly the exchange rate, it will be hard hit.

Also read: Year of Transformation

Fourth, communication. This exit strategy must be well communicated by the government, BI and OJK. The experience with taper tantrums reminds us how important communication is. I remember, at a limited meeting, about the early warning at the IMF and the G-20, I and Raghuram Rajan — the governor of the Central Bank of India at that time — were asked to share our experiences and views on taper tantrums and their impact on emerging markets. One of the messages conveyed was the importance of clarity and how the Fed communicated its normalization plan so that the emerging markets could anticipate it.

/https%3A%2F%2Fkompas.id%2Fwp-content%2Fuploads%2F2018%2F05%2F515211_getattachment7bbea9fd-7fa7-487b-9963-8e7aea7c3a85506595.jpg)

Chatib Basri

On a national scale, the government and BI need to communicate this well so that the business world, financial markets and the public can prepare themselves so that panic can be prevented. This writing is probably too early. However, we do have to prepare from now on. That is why this paper seems to be awkward. It comes up too fast, when it is almost too late. It reminds me that Austrian writer Franz Werfel wrote, "Between too early and too late, there is never more than a moment."

Muhamad Chatib Basri, Lecturer at the School of Economics and Business, University of Indonesia.

This article was translated by Hendarsyah Tarmizi.