Printing Money During Pandemic

The word "money printing" is often negatively connoted. This is true when referring to the theory of monetary figure Milton Friedman (1969) about “helicopter money”.

/https%3A%2F%2Fkompas.id%2Fwp-content%2Fuploads%2F2020%2F05%2Feb7af305-7a50-4648-a824-527b70bdde6d_jpg.jpg)

Busyness at PT Bank Mandiri (Persero) Tbk\'s Cash Center, Jakarta, Friday (8/5/2020).

The word "money printing" is often negatively connoted. This is true when referring to the theory of monetary figure Milton Friedman (1969) about “helicopter money”.

According to Friedman, if the central bank increases its supply of money by printing new money, it can cause a high rise in inflation and can lead to stagnation or slow economic growth. The slow economic growth, which is accompanied by high inflation, is known as stagflation.

Is Friedman\'s theory, which is more than 40 years old, still relevant to today\'s modern economic era? Is it true that printing excess money can cause a significant increase in the prices of goods (high inflation)? By increasing the money supply in the economy, is it able to drive the wheel of the economy or is it even wasteful because the economy remains sluggish? For that reason it is better for us to reopen the memory sheet of the 2008 global economic crisis.

Also read : Fiscal and Monetary Synergy

The 2008 global economic crisis was one of the most important events in the global economic civilization. History records the fall of Lehman Brothers as the fourth-largest giant investment bank in the United States. Lehman Brothers was a victim of bad credit in the property sector (subprime mortgages). Reportedly, it was said to be the biggest bankruptcy in the history of the US economy. So it can be imagined how big an impact the Lehman Brothers damage had on the US economy and the world at that time.

Developed country steroid

The 2008 economic crisis drained the resources owned by the countries in the world and caused extreme panic. The US central bank (The Fed) was taking super loose monetary policy steps. In a short period of time (16 months), the Fed lowered its benchmark interest rate (FFR) to near zero percent. FFR fell 5 percentage points from 5.25 percent in August 2007 to 0.25 percent in December 2008. I think this is the first steroid or antibiotic to help the US economy which was under threat with recession.

It was not enough with the very aggressive reduction of the benchmark interest rates. The US central bank also took the step of loose unconventional monetary policy, namely quantitative easing (QE), or so-called money printing. The central bank added around US$1.35 trillion to the money supply in the US economy in 2008, from US$0.89 trillion in 2007 to US$2.24 trillion. This figure was very fantastic and the QE lasted for almost seven years, ending in 2014. The addition of money supply was calculated at around US$3.61 trillion during the 2008-2014 period. This QE is what we consider to be the second antibiotic.

Also read : Special Liquidity Loans

Federal Reserve Chairman Jerome Powell speaks at his news conference following the two-day meeting of the Federal Open Market Committee (FOMC) meeting on interest rate policy in Washington, U.S., January 29, 2020.

So it is very clear here, the US economic recovery process seemed to have been forced to use two steroids/strong drugs, not being dominated by its own muscles naturally. This had proven to make the US economy unhealthy, because in reality the US economy finally fell to the brink of recession in 2009.

The dependence of the US economy on low interest rate antibiotics and QE is particularly evident when the two antibiotics were withdrawn slowly at the end of 2015, where the US benchmark interest rate was gradually increased by 0.25 percent to 0.5 percent (December 2015). The money supply began to be reduced in stages, namely US$0.01 trillion (in 2015). The US economy was starting to show signs of stagnation and slowing down. The peak of the US economy occurred in the first quarter of 2019, growing around 2.7 percent, then gradually declined and worsened during the Covid-19 pandemic.

Also read : Health and Economy under One Control

The same antibiotics were also used by European and Japanese central banks. The results were predictable, similar to the US. The European Union and Japan were both having trouble to recover their economies and were also in danger of recession. For the record, the European Union\'s zero percent interest rate was already at its lowest. For Japan, it even had negative interest rates. This was a silent witness of how aggressive the loose monetary policies being pursued by the US, European Union and Japan were.

The global economic recession in 2020 seems to be much worse than the 2008 world economic crisis. The Covid-19 pandemic proves to have devastated the world economy. Various economic indicators have significantly deteriorated. World trade (exports and imports), manufacturing production, use of production capacity, retail sales, consumer confidence, unemployment, commodity prices and many other indicators show an almost similar and acute severity.

The absence of a Covid-19 vaccine has caused higher uncertainty than during the 2008 global economic crisis. Nobody can be sure when it will end, how severe it will be and how well the world will be able to survive during this pandemic. Maybe the current recession will be like the Great Depression in 1930, possibly even worse?

Also read : US-China Tension

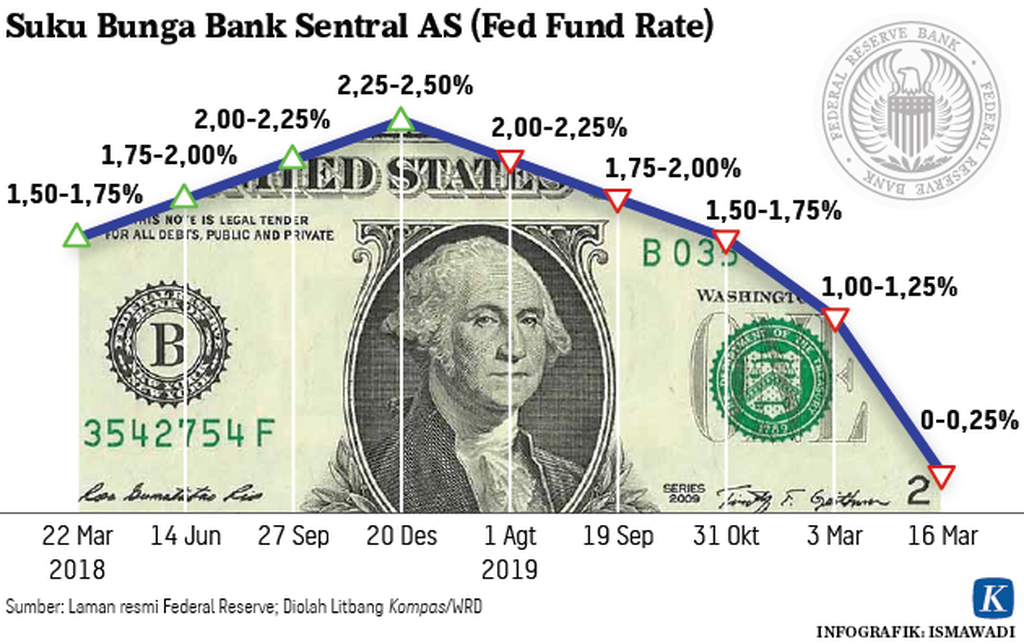

US Central Bank Interest Rates

To overcome the deterioration of the global economy caused by the Covid-19 pandemic, the same prescription was used as in the 2008 crisis. The world hopes to recover soon by using the same two antibiotics, namely low interest rates and aggressive QE.

The benchmark interest rate has been lowered aggressively in various countries. In the most developed countries, the benchmark interest rate is near zero, even negative such as Japan (minus 0.1 percent), Eurozone (minus 0.5 percent), Denmark (minus 0.75 percent), and Switzerland (minus 0.75 percent) This means that the nominal value of money in savings is increasingly eroded/reduced. Due to the low reference interest rates, real interest rates are negative in most countries (return from negative investment).

Also read : Opportunities to Minimize Recession

Not enough with low interest rates, the central banks of developed countries also flood their economies with money through QE monetary policy. The US operates super loose QE monetary policy again although it proved ineffective in overcoming the 2008 global economic crisis. The US is printing money on a large scale, far exceeding 2008. The Fed\'s assets were recorded at US$7.1 trillion as of 26 June 2020, or up US$2.9 trillion compared to 2019. Aggressive QE does not seem to work to increase US domestic demand.

The inflation trend tended to drop significantly to 0.12 percent in May 2020 from 2.3 percent in December 2019. Milton Friedman\'s Theory (MV = PQ, M = money supply, V = velocity of money, P = price, and Q = output) does not apply to the US economy, as well as other developed countries (Europe and Japan).

There are several reasons for the failure of Friedman\'s theory in the US, namely: (1) US velocity of money dropped dramatically from 10.6 in the second quarter of 2008 to 5.5 in the fourth quarter of 2019. This means that the leverage of money supply is only half that of 2008 in driving economic output and (2) the US people tend to take precautionary measures so they tend to save and are not consumptive. This can be seen from the level of savings that increased significantly by around 33 percent, the highest in the US economy for almost 100 years.

Money printing by the US central bank seems wasteful, as it is not able to leverage domestic demand (reflected in low inflation, and even threatened with deflation). Additional money supply tends to backfire because the money flows into the stock and bond markets and does not fully survive in the real sector. This raises the risk in the future, there is a potential bubble in the stock market and it can be a time bomb that is ready to explode at any time.

The signs are already there, when the assets of the Fed rose significantly this year, it turned out that the index of US economic activity was not rising, but dropping significantly, namely negative 7.6 percent on 27 June 2020. The price of Dow Jones Industrial (DJI) shares rose significantly from 18,591 on 23 March 2020 to 27,000 in June 2020.

Sharing the burden of the Finance Ministry-BI

Looking at the US experience, what should Indonesia do to save the economy, which is stricken by the Covid-19 pandemic? Is it necessary to print money as the US and other developed countries have done?

There is no need for Indonesia to imitate QE policies aggressively as done by developed countries. The fundamentals and structure of the Indonesian economy are very different from the US or other developed countries. The US is in a situation of being trapped toward deflation due to weak demand. The addition to the supply of US dollars is not a problem for the US because the US dollar is a hard currency that is used throughout the world.

Also read : The Impact of Recession on Poverty

Indonesia does need a huge amount of funds to overcome the Covid-19 pandemic in order to avoid an economic crisis. Indonesia needs extra funds for health, provision of direct cash assistance to the public, and liquidity assistance for the business world, especially MSMEs. Meanwhile, the state budget is very limited and is not sufficient to finance a sluggish economy because tax revenues have fallen significantly due to the weak economic activity.

Economic stimulus funds cannot only be the burden of the government because excessive issuance of debt securities will result in very high costs. I think BI can play a role, not only by lowering the benchmark interest rate, but also by increasing the supply of fresh money in the economy (QE).

Also read : Health and Economy under One Control

/https%3A%2F%2Fkompas.id%2Fwp-content%2Fuploads%2F2020%2F03%2F9036472b-3d15-459e-a82a-e2681496d34e_jpg.jpg)

Officers prepare rupiahs at the currency exchange place of PT Ayu Masagung, Kwitang, Central Jakarta, Tuesday (31/3/2020).

BI should be capable of calculating how much to increase the money supply in order to support economic recovery. The point is to prevent an increase in the money supply in the community from resulting in an increase in excessive inflation. High inflation is an enemy of the economy and the people, encourages an increase in interest rates, pressures the exchange rate of the rupiah against the US dollar, and increases yields on Indonesian bonds.

I think BI\'s monetary expansion capacity is still quite strong. BI\'s capital is recorded at Rp 3.7 trillion as of December 2019 (far above the requirement of Law No. 3 of 2004, according to which the minimum capital of BI is Rp 2 trillion) and its capital ratio is very healthy at around 11.1 percent. The scenario of sharing the burden between the Finance Ministry and BI for national economic recovery shows the solidity of these two institutions. This burden must be divided so that the risk is not centered at one point. However, they must still be aware of risks going forward, namely (1) monetization of government debt could be out of control because of an increase in the fiscal deficit and (2) BI is perceived to be less independent.

The reasonable reaction is that there are many who disagree if BI prints money now because Indonesia was traumatized during the 1998 economic crisis. At that time, hyperinflation reached up to 58 percent and there was a moral hazard because banks that were helped at the same time acted as debtors, thereby further aggravating the economic recession. The current condition is far different from the conditions of the 1998 recession. Indonesian banking is much better in terms of good corporate governance (GCG), risk mitigation and financial performance.

Anton Hendranata

Printing money to help the state budget is not taboo. The most important is measurable and reasonable, there is no need to be as aggressive as other countries. Indonesia needs an injection of funds to help the poor, daily workers whose income has dropped significantly, and the business world, especially MSMEs. We can avoid opportunities for moral hazard as long as there is commitment, discipline and responsibility to channel them to the right groups and with sincerely good intention.

Anton Hendranata, Economic observer.